Diversified portfolios have performed well across all risk levels and are broadly at market highs. This reflects positive developments, including tariff negotiations resolving more favorably than initially feared and both consumers and corporations demonstrating greater resilience than expected. Consequently, US and international stocks, alongside aggregate bonds, have generally appreciated, rewarding diversified investors. Though debt and inflation fears remain, the most significant driver appears to be the market’s pivot away from pricing in the tail risk of a severe, policy-induced downturn; with the acute fear of a trade war diminished, investor focus has returned to the path of monetary policy, allowing expectations of future Federal Reserve rate cuts to enhance both equity and fixed-income valuations

Stablecoins are entering the financial system, but are not investable assets. The recent GENIUS Act primarily targets stablecoins, mandating that issuers fully back them with safe, liquid assets like U.S. Treasurys to enforce bank-like safeguards. By design, a stablecoin's value is pegged 1:1 to a currency like the U.S. dollar, making it a transactional tool for fast, global payments rather than an investment for capital appreciation. Stablecoins should be viewed as a transactional cash alternative, but not an investment holding since they do not generate returns and are barred by U.S. law from paying interest. While their utility for near-instant settlement is growing, their role in a portfolio is limited to that of a temporary vehicle for liquidity, and investors must still consider the issuer's credit risk, which is only partially mitigated by the new regulations.

Recent crypto legislation is driving interest in bitcoin. Although the GENIUS Act does not directly regulate volatile assets like Bitcoin, its establishment of a robust regulatory framework for stablecoins lends broader legitimacy to the entire digital asset ecosystem. By integrating a significant part of the blockchain world into the traditional financial system with clear safeguards, the Act reduces perceived systemic risk and increases investor confidence in related, familiar structures like Bitcoin ETFs. This growing acceptance, however, does not alter Bitcoin's fundamental risk profile, which remains exceptionally volatile and statistically unstable compared to traditional assets. Therefore, while the ecosystem matures, applying a sophisticated, portfolio-wide optimization approach is crucial to managing Bitcoin's unique risks, rather than relying on simplistic rules often used for allocating to alternative assets.

Key Takeaways:

- New crypto laws are focused on creating regulated "digital dollars" (stablecoins), not on Bitcoin itself.

- The risks involved in investing in bitcoin, or other alternative assets, are best mitigated as part of an optimized portfolio with ongoing rebalancing.

- Unlike stablecoins, Bitcoin remains extremely volatile and is not backed by any asset.

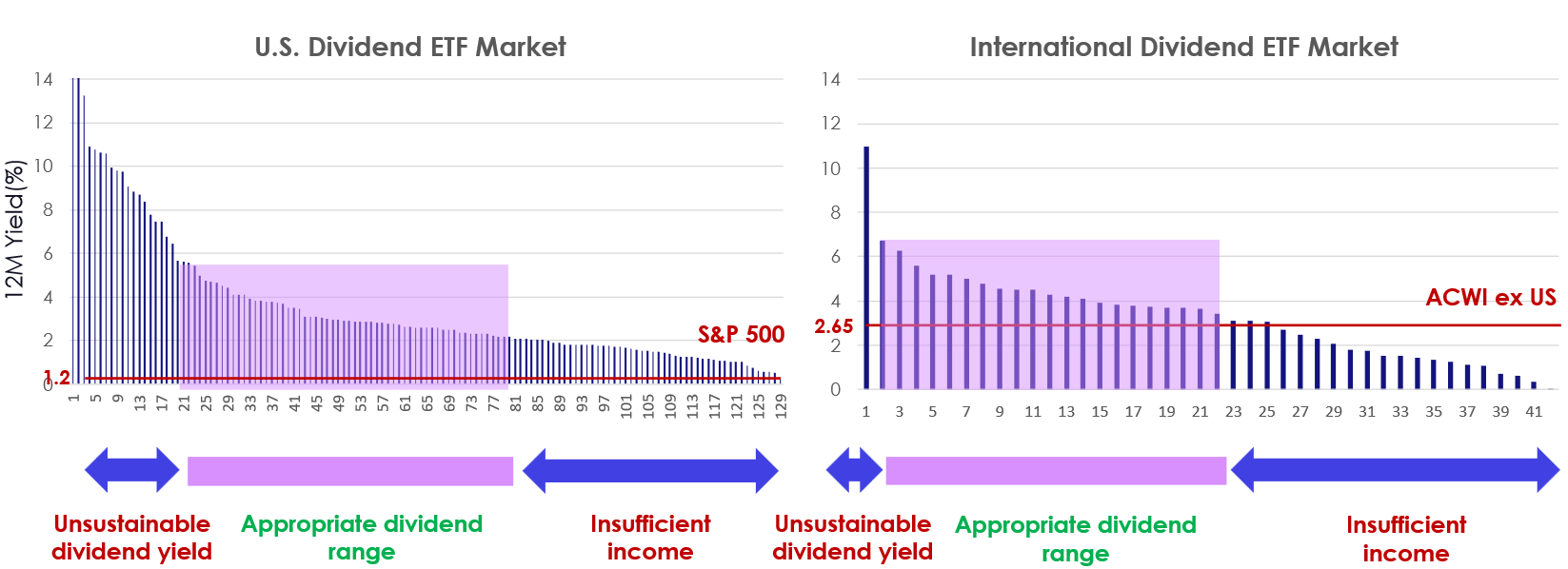

Constructing multi-asset income portfolios requires a sophisticated approach to selecting dividend ETFs, as methodologies for capturing dividend opportunities vary widely. Our process moves beyond simply chasing the highest yield—a practice that can lead to unintended exposure to low-quality or distressed companies. Instead, we conduct a rigorous analysis of each fund's index design, evaluating how stocks are selected, screened for quality, and weighted. These design choices create inherent trade-offs between maximizing current income and ensuring long-term stability and capital appreciation.

Recognizing that no single methodology is always best across all the desired characteristics of dividend outperformance, capital preservation, and risk management, we build portfolios by thoughtfully combining complementary strategies to meet specific income and risk objectives. The graph shown below illustrates the complexity of selecting amongst nearly 200 dividend-focused ETFs. Our approach is centered on blending three core types of dividend ETFs:

- Broad Dividend: Offers diversified, market-aware dividend exposure.

- Focused Dividend: Prioritizes income through targeted dividend screening and weighting.

- Optimized Dividend: Balances dividend signals with risk models to maximize income while managing total portfolio risk.

By integrating these distinct approaches, particularly using an optimized core, we address common pitfalls like uncompensated risk or significant sector bias. This disciplined process of ETF selection and robust portfolio construction allows our multi-asset income portfolios to deliver a stable income stream, currently yielding approximately 5%, while maintaining effective diversification and alignment with long-term investment goals.

Key takeaways:

- Our dividend ETF lineup reflects a thoughtful selection process focused on identifying best-in-class dividend strategies that support income, capital appreciation, and risk management.

- Dividend ETFs vary widely, so a diversified approach makes for a more robust income portfolio.

Source: Bloomberg