Summary

- Well-optimized portfolios can result in a better fit for investors’ goals

- Portfolios that only shift the allocation of stocks vs. bonds don’t customize the underlying holdings to address investor risk and return preferences

- At New Frontier, each portfolio on the efficient frontier is a unique solution – optimized to achieve its own investment objective, not a scaled version of another

Uncorrelated returns reflect customized optimization

New Frontier’s conservative and aggressive portfolios sometimes move in different directions. This contrasts to traditional portfolios, where different risk targets within a strategy move in the same direction, just more or less. However, the difference highlights a feature of properly-optimized portfolios – conservative and aggressive portfolios should perform differently because they’re made for different investment goals (as illustrated in the first figure below).

Allocations are optimized independently

The holdings in an optimized conservative portfolio differ from a scaled-down version of its aggressive counterpart. This is a feature of properly-optimized portfolios – the efficient frontier famously curves because every point on it represents a uniquely optimized combination of assets. Therefore, our portfolios are designed to have different risk exposures, not just different risk amounts, and will react differently to economic news. The results are a better fit for investor goals.

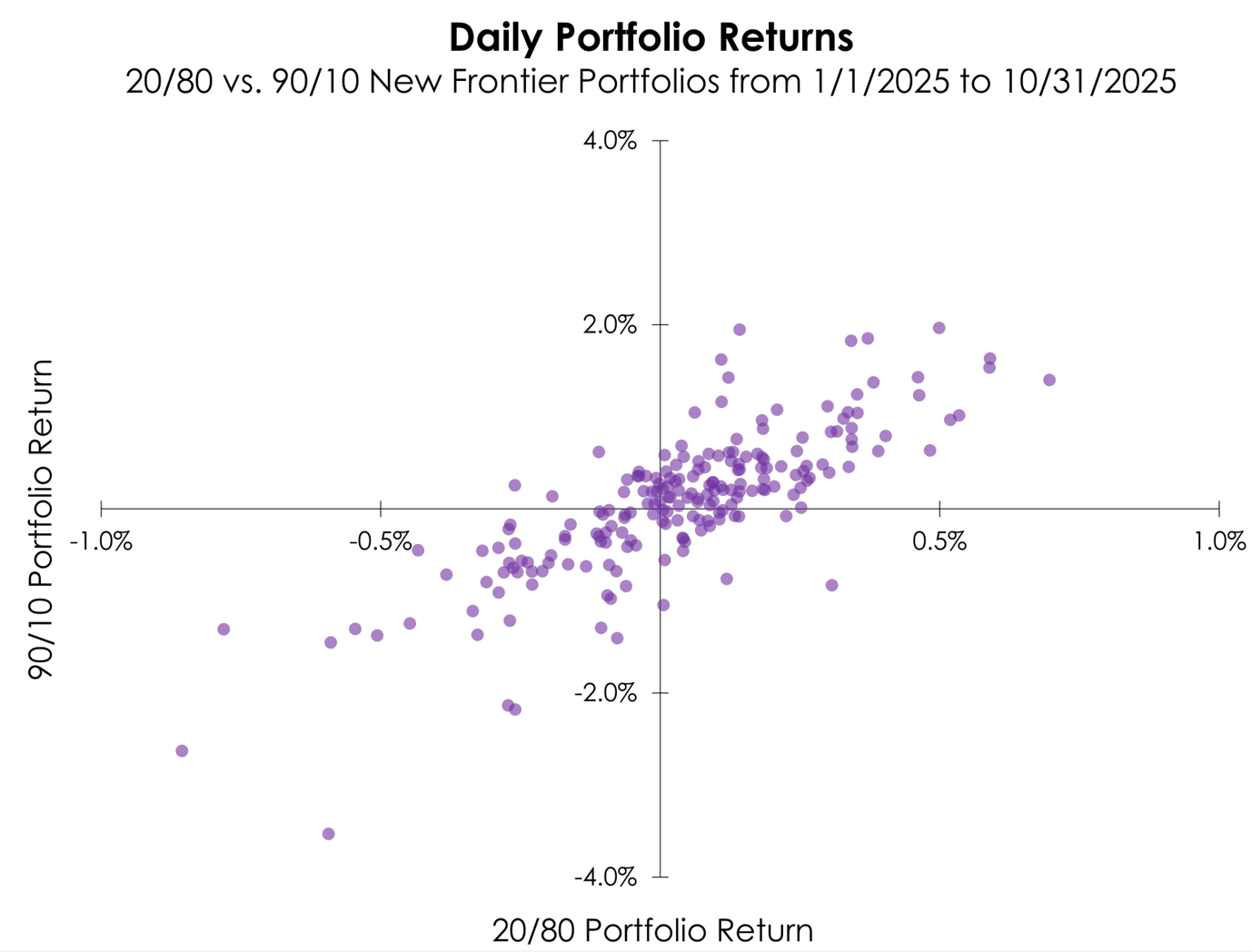

New Frontier Portfolios Do Not Move in Sync

The chart below plots the daily returns YTD of our aggressive 90/10 portfolio (Y-axis) against our conservative 20/80 portfolio (X-axis). The purple dots represent the realized returns of both optimized New Frontier portfolios on a given date. These deviate from a straight-line relationship, highlighting their different reactions to markets day-by-day – observations in the top-left and bottom-right quadrants are examples where the two portfolios moved in opposite directions.

Source: Bloomberg/New Frontier calculations

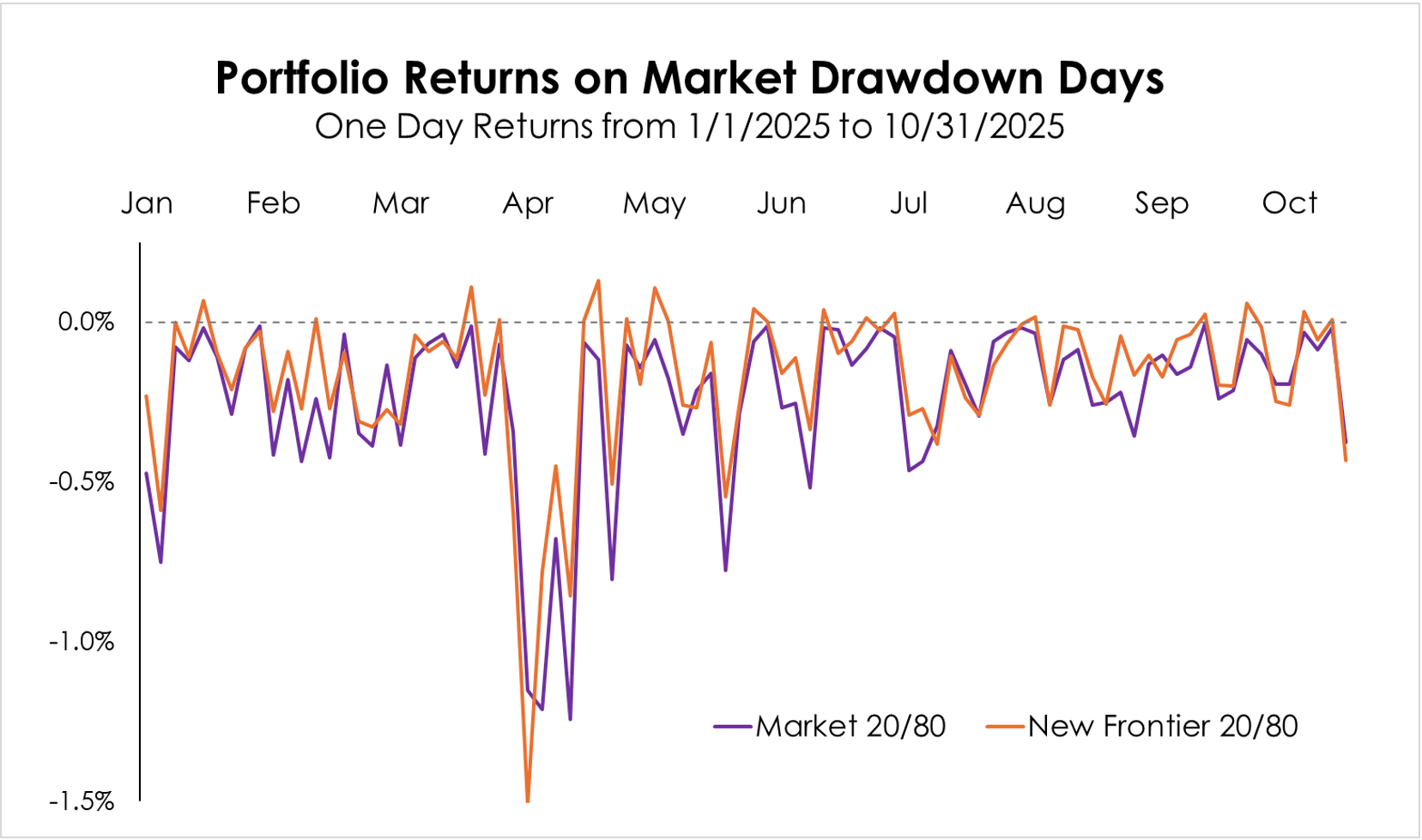

Optimized Conservative Portfolios Manage Risk

The chart below plots the daily returns YTD of both the 20/80 market portfolio (purple, calculated as 20/80 weighted ACWI/AGG daily return) and New Frontier’s optimized conservative 20/80 portfolio (orange), on days when the market lost value. While both were subject to the downside of the market, particularly the April volatility, the optimized portfolio generally exhibited less volatility and lower declines.

|

|

Market 20/80 |

New Frontier 20/80 |

|

Average Return |

-0.24% |

-0.17% |

|

Annualized STD |

4.11% |

3.80% |

Source: Bloomberg/New Frontier calculations

In Conclusion

At New Frontier, our conservative and aggressive portfolios sometimes move in different directions – and that’s not a mistake, it’s design.

Our conservative portfolio isn’t just a dampened version of an aggressive one. Each portfolio is independently optimized to achieve a distinct investment goal, with its own mix of risks and exposures. That’s why well-constructed portfolios often react differently to market shifts – and why that difference can better serve investors’ objectives.

Past performance does not guarantee future results. There are risks involved with investing, including possible loss of principal.

Link to Author Bio

Robert Michaud