After three quarters of improving economic outlook amid increasing expectations for a painless decline in global inflation, markets and pundits alike have become less optimistic about a soft landing as they reacted to frustration from the Fed. In an unfavorable scenario for stock and bond investors in a quarter with little fundamental change, economic worries increased while interest rates rose sharply as the expectation materialized that interest rates would have to stay higher for longer to further slow the economy in the battle against inflation.

Market Performance

The hawkish surprise from the Federal Reserve to keep rates higher for longer than previously projected overshadowed discussions of a potential economic soft landing earlier in the quarter. The Fed policy shift was largely driven by an uptick in August headline inflation due to higher energy prices and stronger economic activity than anticipated. The S&P 500 fell 4.3% in the last two weeks of September, erasing its previous gains and resulting in a 3.2% loss for the third quarter. Energy stocks were the best performing sector. U.S. Large-cap growth stocks that benefited from market excitement about AI in the first half of the year did not sustain their momentum, underperforming value stocks this quarter but still leading year-to-date.

International markets were not spared, though dispersion was low with most markets down similar levels as ACWI ex-US fell 4.5%. European equities fell the most by 5.6%, followed by Emerging Markets (-3.5%) and Asia-Pacific (-3.2%) on the back of the stronger U.S. dollar and weakening growth. Overall, global equities lost 3.7% for the quarter.

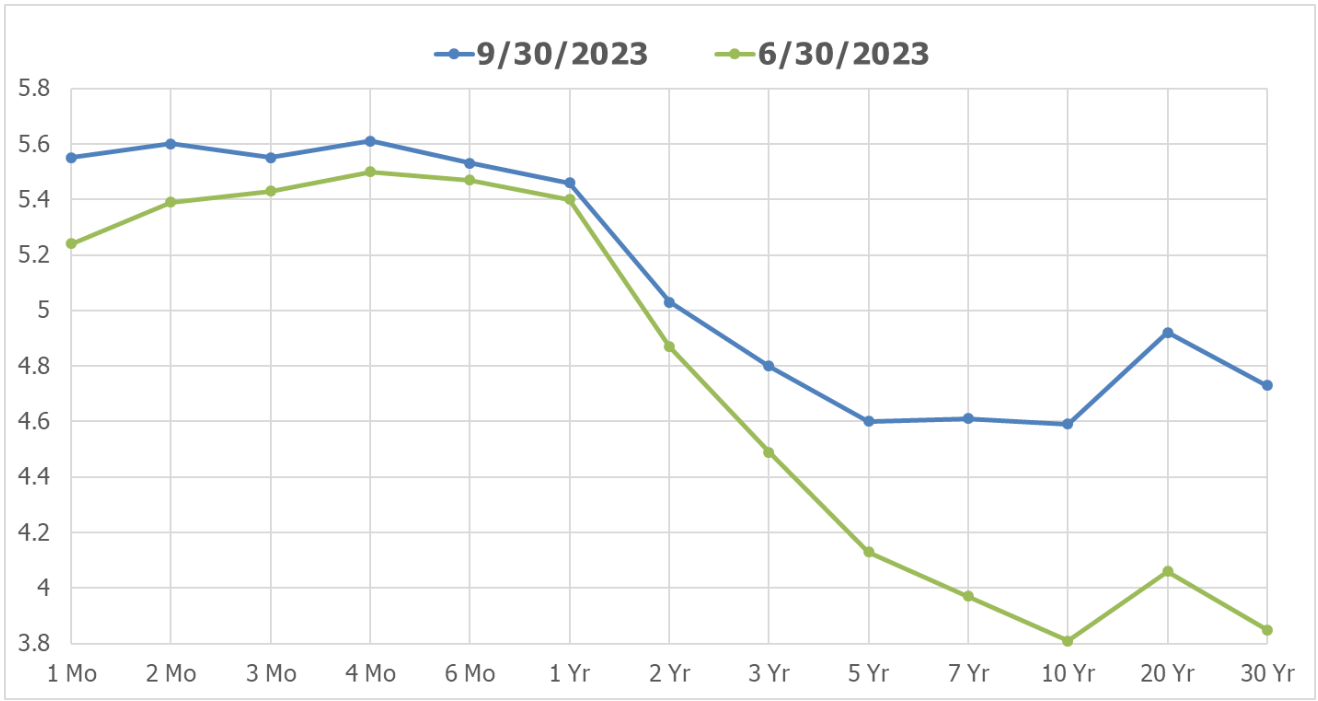

The Fed’s policy shift also injected a dose of volatility into bond markets as well. Rising yields led to a loss of 3.2% for U.S. Aggregate bonds. The U.S. yield curve remained inverted, but less steep compared to the start of the quarter. Notably, the 10-year Treasury yield increased by 74 basis points reaching 4.6% - its highest level since 2007. Additionally, the U.S. dollar was up 3.2%, putting downward pressure on USD-denominated Emerging Market bonds and international Treasurys.

Strategy Performance

In line with losses for all major asset classes (except short bonds), all New Frontier’s ETF portfolios ended the quarter with negative returns.

For Global Core, the portfolio’s negative returns can be attributed to both equities and bonds. All equities were down, with U.S. small-cap growth stocks and U.S. REITs falling the most. U.S. minimum volatility stocks held up relatively better than the broad markets, adding to the relative performance for lower risk profiles. Bonds had a challenging quarter. Long-duration bonds had the biggest loss of 11.8%, while short-term bonds and high yield bonds remained positive, being the major contributors to the portfolio performance. Treasury floating rate bonds performed the best, up 1.34%, currently having a positive spread over 3-mo Treasury Bills. For Tax-Sensitive, municipal bonds didn't perform as well as their taxable counterparts.

For Multi-asset Income, the high-dividend stocks led the broader markets. Among dividend stocks, U.S. small-cap dividends outperformed the large-cap peers and international dividends performed better than U.S. dividends this quarter. Notably, Emerging Markets dividends increased by 0.8%, a significant driver of our portfolio's performance.

Model Reallocation

There were no model rebalances this quarter. All models have been updated for recent market conditions, in particular the yield curve, and all but the tax sensitive models rebalanced late in the first quarter.

Additional refinements within the investment process include higher duration for mortgage-backed securities as decreased refinancing shifts their risk characteristics. Optimal allocations shifted to lower duration including a major allocation to ultra-low duration Treasury Floating Rate Notes. This was a consequence of the relatively favorable risk-return characteristics of shorter duration bonds, rather than a directional bet on interest rates, and proved to be beneficial in hindsight.

New Frontier uses the Michaud-Esch portfolio rebalance test to guide portfolio reallocation and rebalancing decisions. This framework allows us to simultaneously consider changes to the risk characteristics of portfolios from price movements, and changes to optimal portfolio exposures from new capital market expectations. The ETF models remain statistically consistent with their investment objectives.

Investment Themes

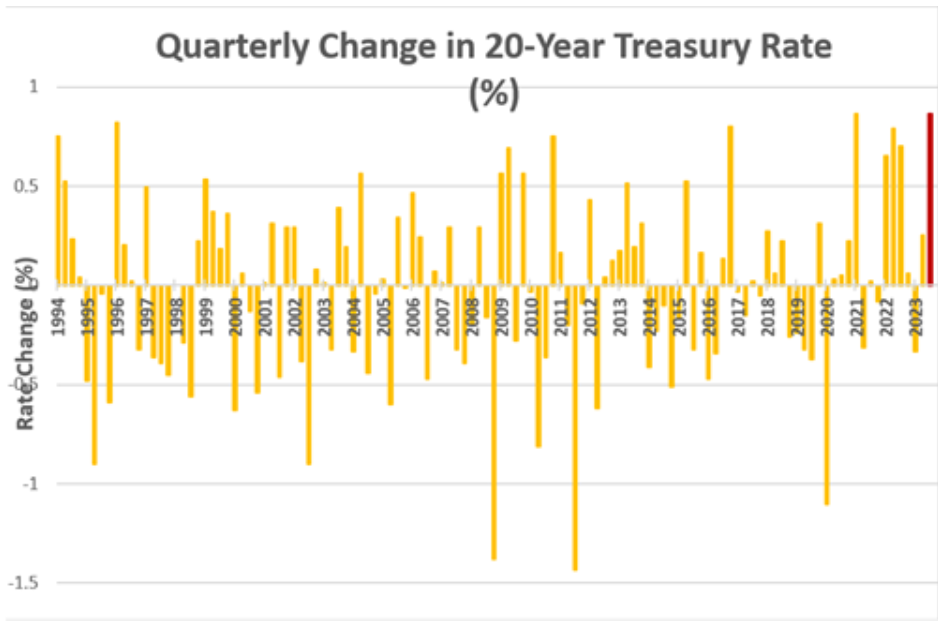

Fixed income markets changed dramatically with one of the fastest moves in history for long bonds. The quarterly rise in 20- and 30-year rates is the highest since the beginning of the FRED data series in 1990.

This rapid rise in long rates effectively raises the cost of capital for firms seeking long-term financing. This along with the existing high short-term rates lessens pressure on the Fed to raise interest rates given that the work of pulling up the yield curve is already done (to some extent).

Source: FRED and New Frontier

Stocks or Bonds?

After difficult periods for investors, many question the relative desirability of stocks and bonds—even more so with risk-free rates at high levels.

Stocks are again being priced for possible recession. If the market has correctly assessed the risk of recession, the price today already accounts for the risks of the future. This narrative implies an uptick in expected return and volatility for stocks going forward. Therefore, from an asset allocation perspective they remain a desirable asset class.

A popular argument for bond investing is that bonds will outperform cash once rates peak—this is mathematically correct, but we don’t know the future path of rates and we do not recommend timing markets. Though our portfolios benefited from not increasing duration last quarter, the same can’t be said for many investors—TLT, the largest long Treasury bond ETF, has had record inflows of $17.5 billion this year. Though many active investors have gotten it wrong, it’s logical to consider bonds as part of a portfolio.

Our case for bonds is based on return and risk. With higher yields, the potential future return from bonds is higher. Importantly, real rates are positive and historically high (roughly 2.2 – 2.4% as of 9/29). Additionally, with higher yield levels and recession as a tangible risk, bonds may benefit the portfolio as a hedge against recession.

Finally, with cash remaining among the higher yielding asset classes with very little volatility, Treasury Floating Rate Notes, for now, remain helpful. Generally, all asset classes potentially have a role if used together in an optimized portfolio.

The Economy

The term “resilient” has been overused to describe the U.S. economy in the face of nearly two years of the Fed trying to slow it down. However, the resilience could be due to economic models measuring out of date statistics rather than exceptional strength of the U.S. economy.

First, let’s consider if it’s possible the U.S. economy really is exceptional compared to the U.S. economy of the past and also other global economies today. If times have changed, then perhaps technology has made the world more economically resilient and we would expect similarly developed economies to experience similar resilience, but we don’t. Or if the U.S. remains the exception today, then it would have to be more exceptional than during the Volker era of the 80s. Since prevailing thought places U.S. exceptionalism today below its historical peak, this too seems unlikely.

A more plausible explanation is that economic models need to be updated. A changing economy with new work habits and geographical ties will take time for economists to properly define and measure. Labor renegotiations and strikes are signs of changing dynamics where the relative value of corporations and employees is uncertain.

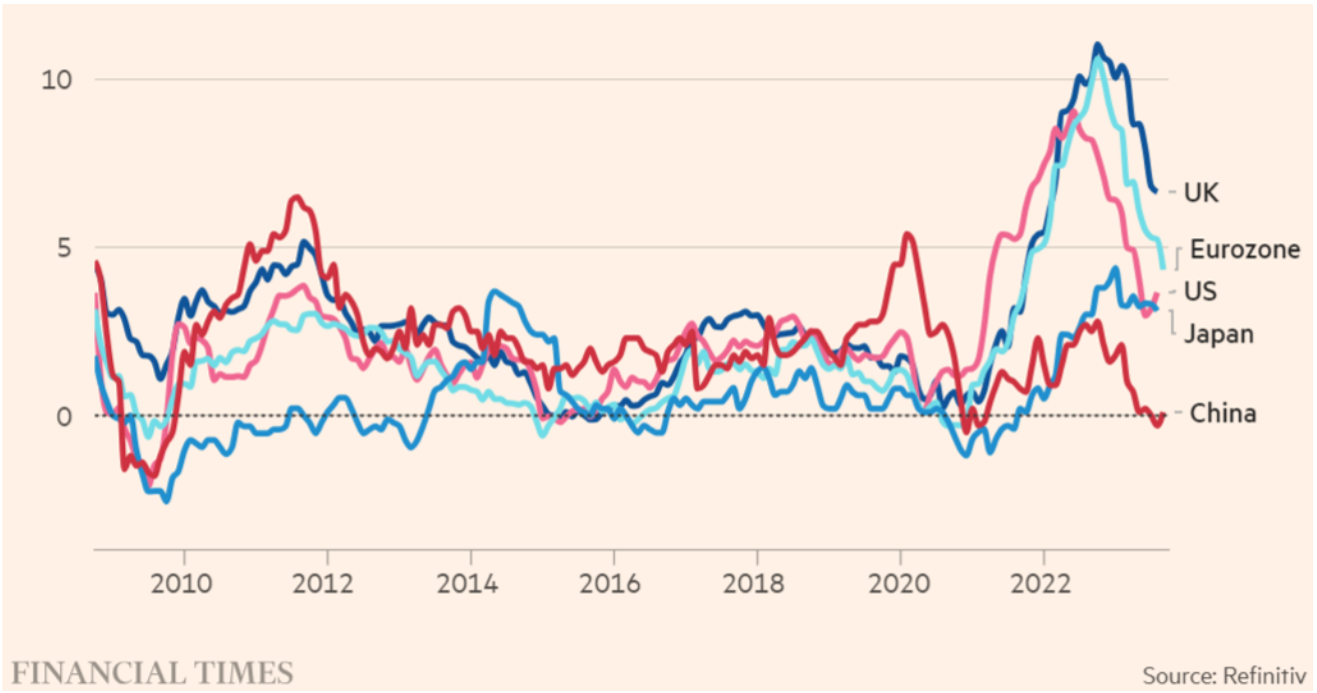

Inflation continues to move in the right direction globally, apart from China which faces deflation.

Global Inflation: Annual % change in CPI

Source: Refinitiv

The Fed

The Fed reiterated its position that further rate increases may be necessary to fight inflation. The Fed then expects to gradually (emphasis on gradually) begin reducing rates starting some time in 2024 and continuing beyond that. This is the “higher for longer” narrative. Markets clearly focused on the “longer” as long-term rates rose dramatically. The strongest message from the Fed, however, is that it will persistently monitor the economy and do whatever it deems necessary in its fight to bring inflation to target levels.

To understand whether the Fed will ultimately prevail, it’s important to consider the historical context.

On one hand, it remains a major concern whether the methods and especially the data of the past remain relevant today. Clearly things change, and there are differences between the current situation and historical times of inflation. This is a reason why simple signals, such as an inverted yield curve, may not be relevant today.

On the other hand, the fundamental laws of economics still work today much as they have in the past. If the Fed is able to impose enough obstacles to economic activity using monetary policy (so long as fiscal stimulus doesn’t interfere), the economy will eventually slow down. That this hasn’t happened yet is somewhat surprising, yet we should not expect the economy to react to policies the same today as in the past. If the Fed persists, it will eventually prevail, although they may have to make even more difficult choices about the collateral damage to the economy and household wealth.

U.S. Treasury Yield Curve

Source: U.S. Department of the Treasury

Comparing the end of quarter yield curve this quarter (blue) to last quarter (green), we see the short end of the yield curve (up to 1 year) change closely reflects the July rate hike. However, longer-term rates rose dramatically this quarter. The 20- and 30-year change was the highest since the FRED data set began in 1990.

The Fed controls the short-term risk-free rate, but markets determine longer rates. As always, market prices are a complex equilibrium from many participants. Market prices do not represent a belief in a single scenario, but rather an average of many expectations and preferences. For example, low yields in the future may be due to investors expecting to profit from those positions or others looking to hedge risks in the future.

Investment Trends

There has been a concerning interest in complex ETFs and other investment products. By many measures, one of the most popular ETFs this year is JEPI, a relatively ordinary fund with the addition of covered calls. So called “buffered” ETFs and annuities have experienced similar popularity and have been touted as having superior risk and return characteristics. There are three important considerations to understand before investing in a buffered or option enhanced fund.

- Insurance is expensive. In the case of buffered investments, buying puts to protect against downside risk requires compensating the seller for the undesirable prospect of large losses in hard economic times.

- Guaranteed income is expensive. On the other end of the spectrum, selling a covered call option exchanges potential upside returns on an asset you own for the income of the price of the call.

- A single fund doesn’t replace a portfolio. Portfolios can be designed so that every allocation is meant to work together to optimize the ability of the portfolio to meet an investment goal. Funds generally have a far more specific objective.

Consequently, many buffered funds have lower expected return and higher fees than their base asset class. This can make them inefficient in a well-constructed portfolio which means the buffer is counterproductive and likely to lower long-term wealth without compensating risk management benefits.

While options have a place to add flexibility and hedge specific risks in a portfolio, they’re not investment alchemy and cannot manufacture riskless wealth.

Other Themes

- Japan has excited investors with open market policies and investor favorable regulations. While we agree with the positive sentiment on Japan, we do not need a single country allocation to Japan given its high weight (nearly 67%) in the Pacific ETF.

- Artificial Intelligence obsession has cooled, but highly meaningful productivity gains remain possible for those who effectively harness the technology as it matures.

- The dollar’s rise this quarter hid modest local currency international equity gains in some markets.

- The dollar’s rise also partially masked inflation this quarter, another reason for market pessimism.

- Regardless of fairness, student loan forgiveness is stimulative to the economy as it encourages consumption by freeing up cash. Therefore, the resumption of loan payments will help the Fed’s efforts to cool the economy.

- Higher oil prices both dampen consumption as a tax on household wealth and add to inflation through higher production costs.

- China’s economic malaise continues with the collapse of real estate firm Country Garden, youth unemployment, potential deflation, and little regulatory progress for foreign investors.

- Many would like to ignore politics for another quarter (at least), but uncertainty from potential government shutdowns adds undesirable volatility to markets. Like many other events that have a modest negative impact on the economy, the damage would likely be mitigated by prompting lesser Fed actions.

- Risk estimates for the year have been largely in line with realized volatility, with the exception of unusually low volatility from high yield bonds. We consider it prudent to use a higher long-term volatility estimate for high yield bonds.

Link to Author Bio

Robert Michaud