A Better Way to Optimize

Michaud OptimizationTM builds customized portfolios designed to address market uncertainty. Our portfolios are more highly diversified and closely aligned to client investment objectives than traditional approaches.

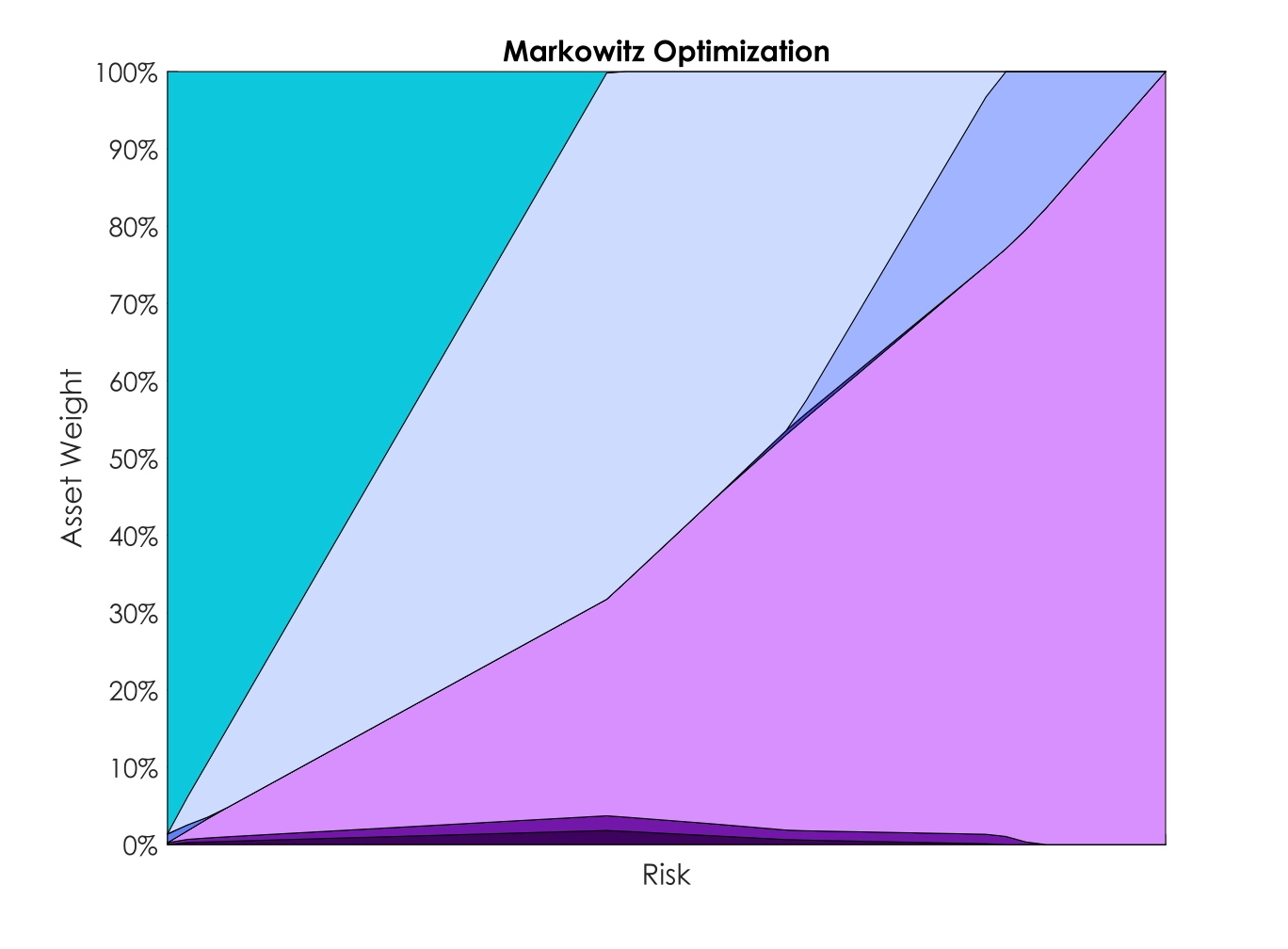

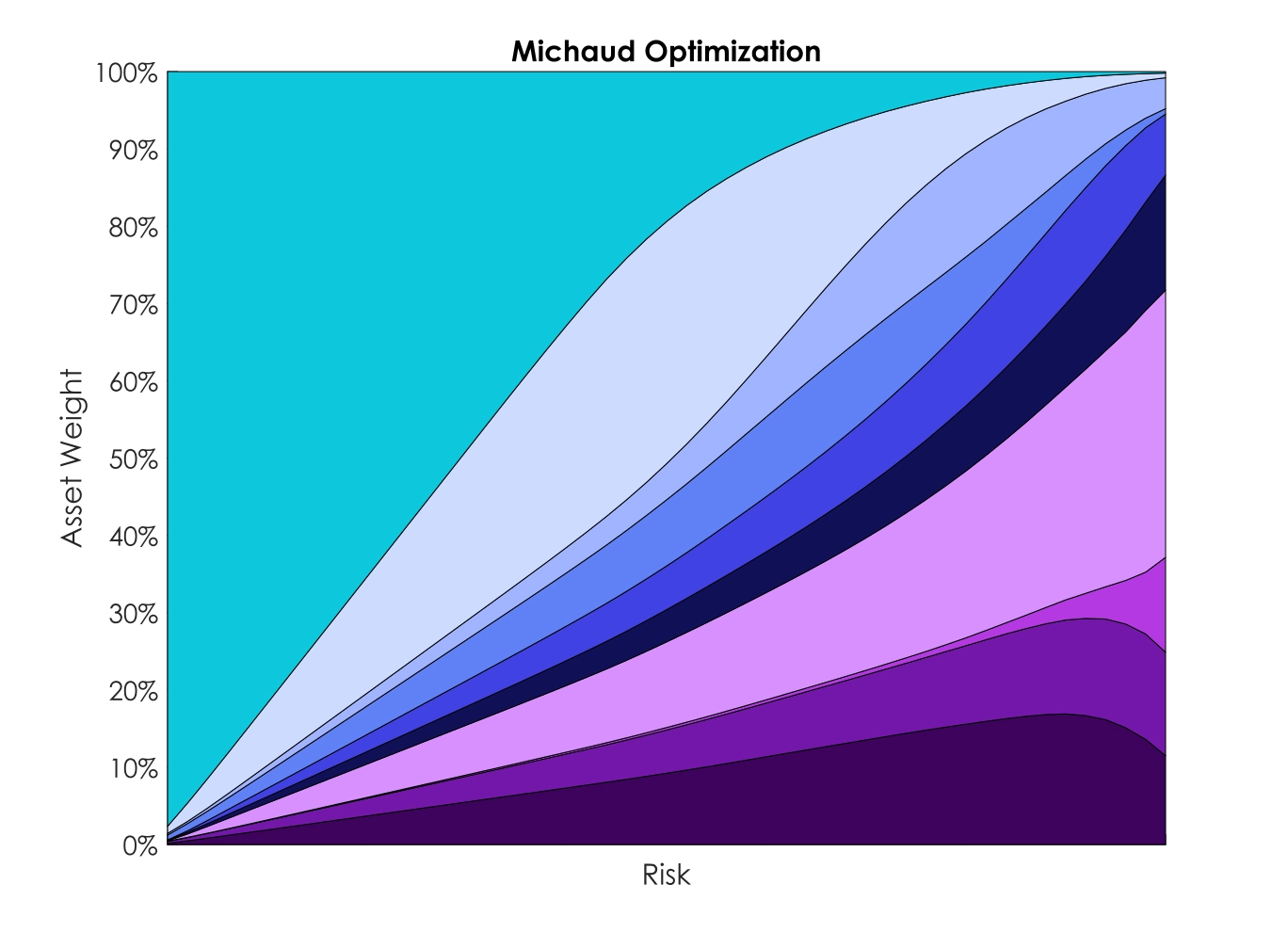

Traditional vs. New Frontier Optimized Portfolio Composition

New Frontier Portfolios

Optimized Security Selection

At New Frontier, we dynamically adjust both the asset allocation and underlying holdings in all of our portfolios.

Conservative portfolios hold lower risk, defensive asset classes. Aggressive portfolios hold asset classes that pursue higher returns.

More Highly Diversified Portfolios

Since 1999, Michaud OptimizationTM has provided a more effective way to diversify portfolios.

Asset Class Composition Maps

Markowitz Mean-Variance Optimization was the institutional standard for 50 years. However, the approach delivered unstable results, inadequate diversification, poor performance, and was difficult to manage.

New Frontier portfolios contain more asset classes and are engineered to account for investment uncertainty. We stress-test thousands of scenarios to adapt to market shifts, creating diversified portfolios that closely align with investor objectives.

Why New Frontier?

Innovative, Proven Optimization

Michaud OptimizationTM addresses market uncertainty to create diversified, market-adaptive portfolios tailored to investor goals.

Daily Portfolio Monitoring

We monitor portfolios daily to maintain the right risk levels for your investment goals. Our technology alerts us when it is time to rebalance.

Intelligent Rebalancing™

Our rebalancing test enhances investment value by trading only when statistically likely to benefit investors.

Tax-Smart Portfolio Optimization

We choose tax-efficient, low-cost ETFs and optimize their unique features to maximize expected after-tax wealth.

Best-in-Class, Nonproprietary ETFs

As an independent asset manager and a pioneer in ETF portfolio construction, we choose the most suitable ETFs, regardless of fund family.

20-Year Track Record

We have consistently managed risk, adapted to evolving markets, and delivered stronger risk-adjusted returns than traditional approaches.

Explore the New Frontier Difference

Connect With Us

Learn more about how we work with financial advisors and institutions to deliver client-focused outcomes.