As the year ends and we look forward to 2025, some larger themes emerge in conversations about what to expect in the near future.

U.S. market tilts are trendy. Market pundits are unusually uniform in predicting the continued outperformance of the U.S. market. Such a strong uniformity of perspectives and sentiment is dangerous for market prices and equilibrium as it implies there is excess capital allocated to the U.S., and consequently less capital allocated internationally. This supports the observation that valuations are high in the U.S. and low internationally. Valuation discrepancies can be supported by different risk and growth estimates in a healthy market. However, investors may not be adequately compensated when investing in high priced securities in a biased market.

Takeaway:

· U.S. market tilts may be risky due to overcrowded sentiment.

Active ETFs need to be more than just tax efficient. 2024 saw a boom in active ETFs. One reason active ETFs are being promoted is because of their tax efficiency. It’s true that an active ETF can be more tax efficient than an active mutual fund. However, it’s also true that actively managed funds, on average, underperform their passive counterparts due to higher management fees and internal trading frictions due to higher turnover. Make sure to invest in the right funds for the right reasons. The best active funds may provide benefits such as dynamic risk management or exposure to underrepresented asset classes, but come at a cost and are not a silver bullet to higher returns (For example, they may have exposure to extra risk in order to seek extra return).

Takeaway:

· All ETFs should be assessed on their contribution to an optimized portfolio. Tax efficiency, expenses and liquidity are important, but the most important consideration of an investment is how it will contribute to the risk and return of your portfolio.

Trump policies may have modest impact on markets. With the changing administration in January, many are questioning the impact of potential policy changes on markets and investments. It is clear that campaign rhetoric does not necessarily translate into policy.

One important example is the new administration’s policy regarding tariffs. Economists almost universally agree that extreme tariffs will result in increased inflation and reduced economic growth once equilibrium settles in from retaliatory tariffs and trade disruptions. During his presidential campaign, Trump proposed tariffs on Chinese imports as high as 60%, and on BRICS imports as high as 100% (source: Trump's Potential 100% Tariff on BRICS De-Dollarization - Business Insider). However, this magnitude of tariffs would be unprecedented and it seems reasonable to assume that something less extreme will be implemented, but nevertheless has led to anxiety about global trade wars.

Should U.S. investors holding global assets shift towards the U.S.? This is an important question that has us all watching for clear signs of policy changes. However, it is never wise to follow a stampede based on fear, but rather, to place holdings in diversified assets, including the contrarian point of view.

Takeaways:

· Financial markets are interpreting the possible impact of tariffs in the new administration.

· Watch to see what will actually happen, and position your investments in an optimally diversified portfolio to minimize the risk.

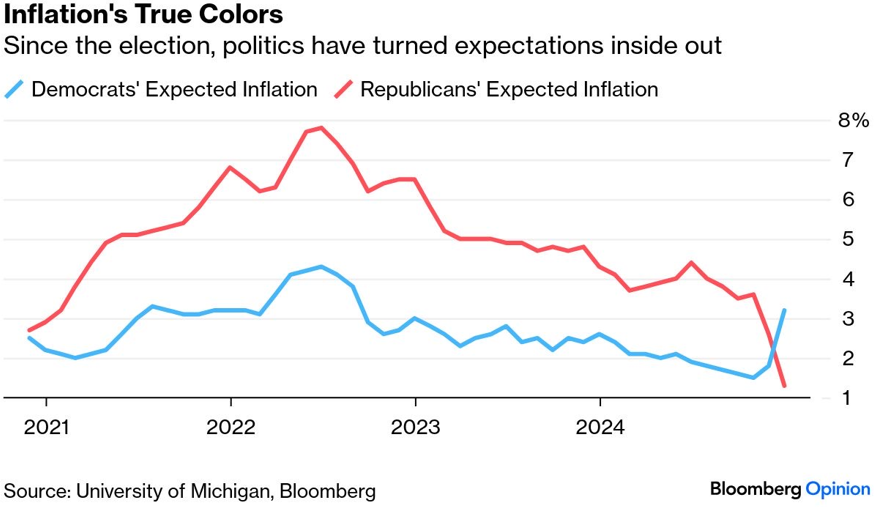

Inflation expectations can be biased. New Frontier is taking a conservative approach to reacting to the news. In particular, our quantitative investment process avoids subjective political biases when investing. For example, inflation is one of the most tracked economic statistics and central to monetary policy. Therefore, one might expect inflation expectations to be apolitical. However, inflation pain became a major point of the election with polarizing political perspectives on the causes and solutions.

Takeaways:

· In 2025, it will be important to stay unbiased.

· New Frontier’s investment process evaluates economic data using technology and investment theory.

The Bloomberg chart below is an example of inflation expectations being heavily biased by political sentiment. Note: This is for illustrative purposes only. New Frontier does not use the chart below in its investment process.