International stocks, particularly in Europe, have outperformed this year. While AI remains critical to market dynamics, stretched valuations and rising capital expenditures in U.S. technology companies have heightened earnings sensitivity. Even when earnings are strong, elevated expectations make it increasingly difficult for companies to deliver meaningful surprises. Meanwhile, technological disruption and increasing competition serve as reminders that even the widest moats can be challenged. This environment has led investors to reconsider their exposure.

Some are returning to value investing—seeking attractively priced stocks with improving fundamentals—while others are seeking new opportunities outside U.S. markets. European equity gains have been supported by a more balanced industry mix and more reasonable valuations this year, with improving earnings expectations and steady economic conditions. Unlike the U.S., where technology dominates, Europe's stock market is more diversified, with a lower-tech weighting (<10%) and greater exposure to financials and consumer-related sectors.

This does not signal the decline of U.S. tech or AI’s importance, but rather an increased awareness of concentration risk. The case for diversification is stronger than ever, as investors seek opportunities beyond the most crowded trades and toward international markets.

Key Takeaways:

· While AI-driven U.S. exceptionalism may continue, high valuations leave less room for error, and any signs of disruption could shift market sentiment, increasing risk for investors with concentrated exposure to U.S. large growth.

· International markets, such as Europe, offer a strong complement to the U.S. with a more diversified sector mix and reasonable valuations.

Gold has benefited strategic portfolios. Gold is up 11%, driven by strong investor demand amid heightened geopolitical risks and trade uncertainties, making it the best-performing asset in many New Frontier portfolios this year. Gold’s safe-haven appeal has reinforced its role as a risk hedge in a portfolio.

While gold has performed well through recent periods of global volatility, we have long viewed gold as a strategic holding for portfolio diversification. Its historical role in reducing total portfolio risk and improving risk-adjusted returns makes it a valuable long-term allocation.

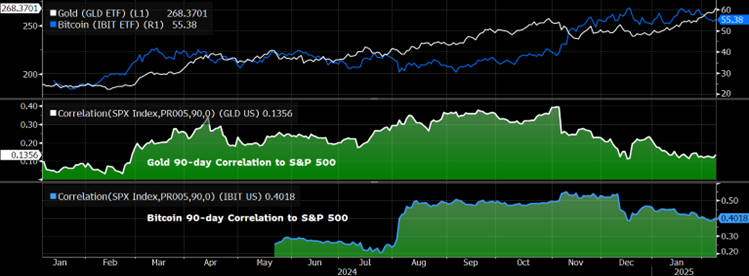

Bitcoin is often cited as a portfolio diversifier. However, since Bitcoin ETFs became available last year, gold has shown a lower correlation to broad equity markets than Bitcoin. Bitcoin’s case as a store of value remains less compelling due to its speculative nature and lack of consensus on intrinsic worth. Additionally, its increasing correlation with equities undermines its reliability as a hedge. While Bitcoin may offer return potential due to its unique risk profile, gold remains the more dependable safe-haven asset in uncertain markets.

In the chart below, we see the 90-day correlation of GLD (gold) is currently .13, compared to .40 for the much more volatile IBIT (Bitcoin).

Gold vs Bitcoin ETF: Price Movement and Correlation to S&P

Source: Bloomberg

Key Takeaways:

· We view gold as a long-term strategic asset for portfolio diversification and risk management.

· Gold remains a more reliable safe-haven asset than Bitcoin, which has shown a higher equity correlation and remains speculative in nature.

Buffered Bitcoin is more Buffer than Bitcoin. Buffered investment products have gained significant popularity in recent years. While specific structures vary, these products generally combine an underlying asset with one or both of: buying a put to mitigate downside risk, and selling a call to generate income (or pay for the put).

As a result, buffered products often diverge significantly from the performance characteristics of their underlying assets and perform more like bonds. While they may offer protection against losses, they also cap upside potential, limiting the opportunity for substantial gains. In the case of buffered crypto products, investors may benefit from reduced volatility but are unlikely to experience returns that track the underlying cryptocurrency. With more aggressive buffering, the longer-term performance of these products may be driven more by the efficiency of derivatives markets than by the price movement of the crypto asset they reference.

Key Takeaways:

· You can’t beat markets with financial engineering.

· Fully protected buffered investments ultimately provide similar returns to the treasury market.

· Risk management can be more effective when applied to the entire portfolio rather than one asset at a time.