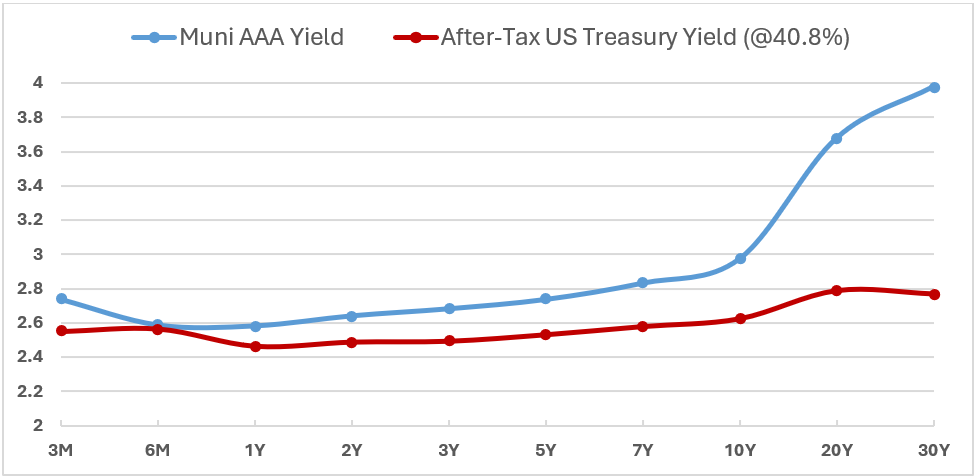

Munis are once again providing higher after-tax income than Treasurys. For much of the last two years, the Federal Reserve had raised short-term Treasury rates to the point where municipal bonds had lower after-tax yields, even for investors in the highest tax brackets. However, this dynamic has shifted as short-term Treasury yields have declined, making Munis relatively more attractive. As shown in the chart below, high-quality Muni bonds now yield more than Treasury bonds on an after-tax basis.

However, Municipal bonds have different risk characteristics than Treasurys. Treasurys are generally considered free of default risk, while municipal bonds have some risk of principal. Munis are also less liquid than Treasurys, making them less valuable in a crisis. As a result, Treasurys may still be useful in a portfolio for managing risk even with slightly lower after-tax yield.

Source: Bloomberg as of 02/21/2025

Takeaway:

- Treasury floating-rate bond ETF (TFLO) was reduced but not eliminated in our Tax Sensitive ETF portfolios in the recent model rebalance, as it continues to offer an attractive risk-free yield.

The rise of Chinese tech stocks shows AI gains are not limited to U.S. tech giants. AI remains a promising technology that can bring substantial productivity gains to those who use it well. Until recently, investors have been heavily betting capital on a handful of U.S. technology giants. Due to the success of AI startups such as China’s DeepSeek, as well as commitments from established Chinese firms such as Tencent and Alibaba, investors are showing renewed interest in China.

Beyond China, European technology firms are also benefiting from AI-driven investment flows. Recently, European tech companies such as ASML, a key supplier of semiconductor equipment, and even Nokia have benefited from AI-motivated investors. As AI adoption expands, its economic impact will likely extend across multiple industries and regions, creating broad-based investment opportunities worldwide.

Takeaways:

- Broad geographical diversification positions a portfolio to capture unexpected growth.

- China has risk from economic headwinds, and an uncertain relationship with the U.S. We therefore do not advocate substantial overallocation to China.

Hot TIPS: The case for inflation-indexed bonds. Treasury Inflation-Protected Securities are well-suited for two notable economic risks – inflation and economic slowdown. Markets are concerned that higher tariffs and other isolationist policies may limit economic growth. While economic uncertainty typically drives investors toward traditional Treasurys, these same policies also heighten inflation risk, which can erode the value of most fixed-income investments. While they are not entirely immune to the secondary effects of inflation – such as interest rate volatility –TIPS provide a valuable tool for investors looking to balance inflation protection with portfolio stability.

Takeaways:

- TIPS are useful in hedging both economic and inflation risk in a portfolio.

- TIPS allocations saw a modest increase in the recent rebalance of our Global Tax Sensitive ETF portfolios.