- Nasdaq 100 index had a “Special Rebalance” on July 24 to address overconcentration in the index by redistributing the weights

a) The rebalance will break from cap weighting by reducing weights of Microsoft, Nvidia, Alphabet and others because of overconcentration due to AI fueled price appreciation

b) This isn’t the first time it’s happened. Apple and Alphabet were already underweighted in the index. In hindsight, it hurt index performance to reduce their weight.

c) Other cap weighted indices such as S&P, Russell and CRSP have not had to reweight. New Frontier uses Russell and CRSP indices for cap-weighted US stock exposure.

d) Note the Nasdaq 100 is a mostly-cap weighted index of the largest 100 non-financial companies that trade on the Nasdaq exchange. It was conceived to promote stocks on the upstart Nasdaq exchange, but is now seen as a tech indicator due to the concentration of its recent composition.

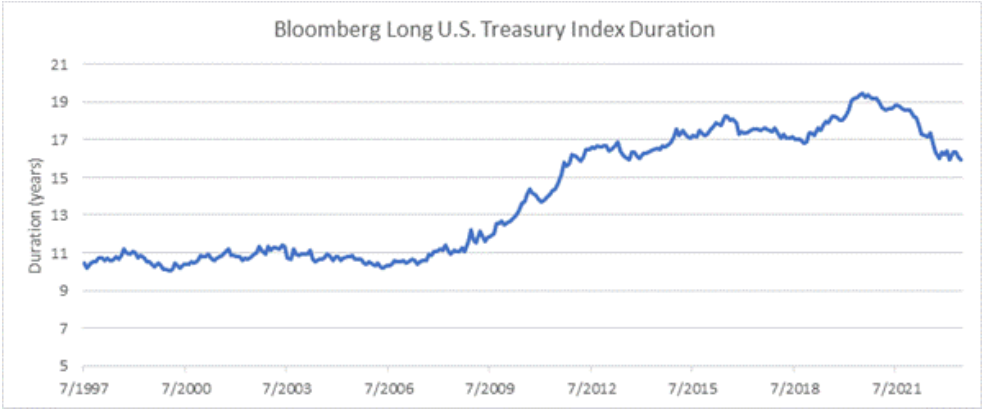

- Equity indices are not the only things that change their exposures. Long US treasury duration changed over time.

a) This is primarily due to the stoppage and reissuance of 30-year Treasurys, but recently affected by rising rates.

b) One consequence is that standard deviation estimates are downward biased when using historical observations before roughly 2012. New Frontier adjusts for this bias when estimating risk.

Source: Bloomberg as of 6/30/2023

- Inflation has been falling around the globe. The most recent CPI print of 3% is a sign that the Federal reserve can slow down rate hikes.

a) This is unlikely to affect this week’s decision which anticipates a 25bp increase.

b) New Frontier portfolios include Treasury Floating Rate Notes which should immediately benefit from the rate increase without the volatility from uncertainty about future Fed actions.

c) The global inflation situation varies across different regions, with the UK and the Eurozone somewhat behind the US, and China at risk of deflation.

Source: Financial Times. Inflation Rate (%) is annual % change in CPO as of June 2023 if not specified

d) Central bank policies have begun to diverge (see table below)

Source: New Frontier and Bloomberg