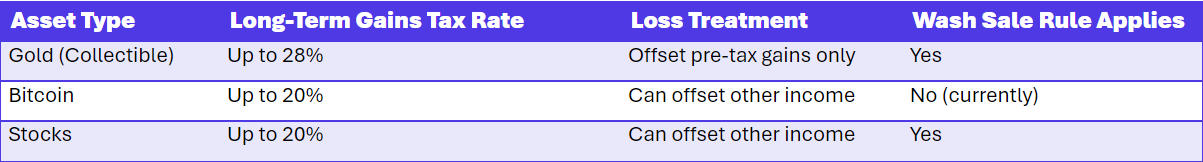

Gold is less optimal in a tax-efficient portfolio. Metals, including gold, are taxed as collectibles, which means their tax rates are higher than other securities. ETFs inherit the properties of their underlying assets, so Gold ETFs are also taxed as collectibles. Long-term gains on collectables are taxed at a maximum rate of 28%, compared to 20% for other securities (short-term gains are taxed at the same rate, but tax-efficient strategies try to avoid taking short-term gains). However, losses for gold can only offset pre-tax gains, which means that losses have less impact on the total tax burden than equivalent gains for a Gold ETF. This asymmetry has a two-fold effect on the after-tax capital market expectations: firstly, the expected after-tax return is less, since positive returns are given a greater haircut and more of the negative returns are allowed to stay; and secondly, the after-tax risk is greater than if losses were allowed to offset the full 28% rate. Both effects imply that an optimizer using after-tax mean and variance assumptions will assign less portfolio weight to a gold asset.

Generally, taxes decrease losses as well as gains, thereby decreasing risk along with return. If the risk and return decreases are comparable, taxes may have little effect on the desirability of an asset, but if losses are affected less than gains, the smaller reduction in risk and greater reduction in return will discourage use of that asset in a tax-aware setting. So, the reduced tax-adjusted efficiency of an asset depends on the distribution of return for that asset. For example, a low-volatility, high-income asset (such as many taxable bonds) may have only taxable income, and rare losses to offset, resulting in large tax penalties with little offsetting risk reduction. Tax loss harvesting practices common today have made losses more valuable in the past, so this approximate calculation is fully applicable. These effects mean that in an optimized tax-efficient portfolio, gold is substantially less desirable relative to a corresponding (tax-exempt) portfolio that uses pre-tax risk and return assumptions. In tax-sensitive optimized portfolios, gold has insignificant weight when included, so New Frontier’s current policy is to exclude Gold ETFs from tax-sensitive strategies.

Tax Treatment of Gold, Bitcoin, and Stocks

An interesting counterpoint: high-dividend stocks are more advantageous to a tax-sensitive strategy than one might think because much of their return comes from dividends which are typically taxed at a qualified rate. After taking out the dividend returns, they are therefore more likely to have capital losses, which makes them more tax efficient. This is why growth stocks are not as dominant in a taxable portfolio as one might expect.

Takeaways:

· Higher tax rates make an asset less desirable to taxable investors, but it also matters how the asset’s return is likely to be taxed.

· Taxes typically affect securities differently due to the different tax treatment of different sources of return: tax exempt income, qualified dividends, capital gains (losses), and collectible gains (losses).

· Distribution of return matters. Taxable bonds have greater penalty than tax-exempt bonds because only gains are typically impacted by taxes.

· High tax rates, such as those applied to collectibles, can make an asset less desirable.

· The collectible tax punishes gains more than it alleviates losses, making assets such as gold relatively less desirable to taxable investors.

Fortunately for would-be investors, Bitcoin is not a collectible: the speculative motivations of crypto investors were recently highlighted by new memecoins. But crypto assets such as bitcoin were always highly volatile. Currently, Bitcoin is taxed as property, meaning capital gains rules apply—similarly to stocks. Investors incur taxes when they sell, exchange, spend, or convert crypto, allowing them to offset losses against gains and benefit from favorable long-term capital gains rates. This tax treatment is particularly valuable given Bitcoin’s volatility, as it enables a symmetric benefit from potential losses. Notably, Bitcoin is currently exempt from the wash sale rule, though this may change in the future. If Bitcoin ETFs were subject to the same asymmetric tax status as collectibles, it would be highly disadvantageous for them.

Takeaway:

· Bitcoin’s potential role in a well-diversified portfolio—as a hedge against inflation or currency risk—is enhanced by its symmetric tax treatment as property for taxable investors.

Concentrating in U.S. large-cap growth stocks is risky – and the challenge from China’s DeepSeek highlights the unexpected disruptions. DeepSeek developed a competitive AI model without relying on the most expensive, advanced chips made by companies like Nvidia. This disrupts the assumption that cutting-edge hardware is essential for top-tier AI—an idea central to Nvidia’s growth story—and that only the biggest U.S. tech players with the largest AI spending can dominate the race. Stock prices of Nvidia and other tech companies fell on the news of DeepSeek.

It's a reminder that innovation can come from places other than the largest tech companies. This holds not just for China, but also for many U.S.-based startups. This news should serve as a warning against excessive concentration risk, which can backfire if markets change unexpectedly, or a new competitor emerges. Markets have been betting heavily on U.S. large-cap tech stocks, reflected by a sizable portion of US market capitalization. A balanced, diversified approach is key to managing risk in an evolving global market. New Frontier’s optimization process neatly avoids these pitfalls, effectively and optimally diversifying across all asset classes, and limiting concentration risk.

Takeaway:

· DeepSeek’s surprising success in AI innovation shows that investors should not presume that breakthrough innovation will come from the expected channels. Intelligent diversification is the best hedge against this risk.