High yield ETFs, particularly short high yield, have been a significant contributor to portfolio performance, providing relatively reliable fixed income return with relatively little volatility. As strong returns continued, credit spreads have narrowed, calling into question the forward return of high yield.

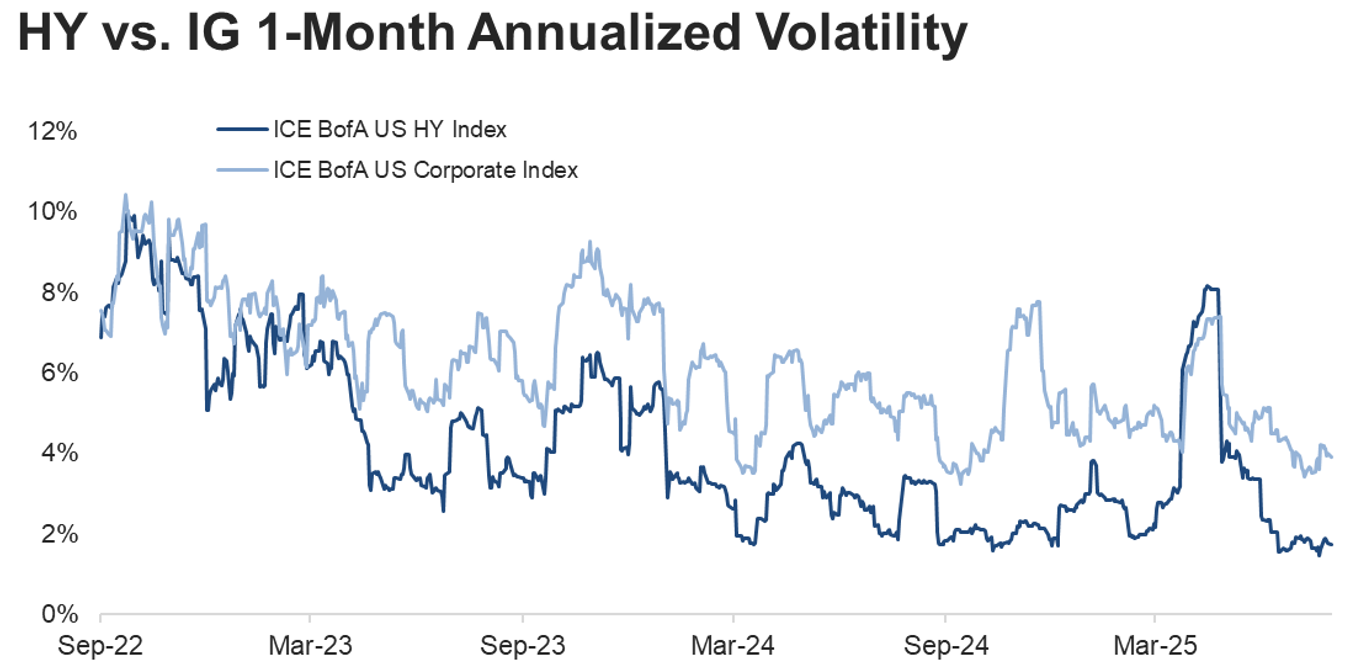

Forecasts of High-yield risk have been low, but narrow spreads leave little margin for error. It is true that high-yield bonds have recently experienced lower volatility than other fixed income asset classes, as shown in the graphic below (figure). But New Frontier’s risk assumptions for the class remain cautious. Unlike our own model’s longer estimation window, others use short-term windows that reflect more recent, calm periods and fail to adequately capture tail risk. Our optimization process avoids over-allocating to high-yield exposures which may appear stable in the short term but carry asymmetric downside across full market cycles. Therefore, we remain deliberate: any high-yield allocation must offer statistically justified return-for-risk.

Source: FRED

High-yield bonds are exposed to both fixed income and equity risks. However, recent volatility has been low as they’ve avoided the risks of both. Like other fixed-income securities, they are sensitive to interest rates and inflation. However, they are generally less sensitive to these effects than other fixed income securities because much of their yield (and therefore total investment return over time) is derived from their credit spread – the extra return investors demand for taking on default risk – rather than a term premium for duration risk. Notably, recent sensitivity to interest rates has been lower than historical as rates have risen or remained high, likely because coincident economic news has generally been positive and investors have deemed the credit spread sufficient compensation.

On the other hand, their high credit risk ties their performance directly to economic health, much like stocks. When the economy is strong and corporate profits are healthy, default risk is low, and high-yield bonds perform well. Conversely, during economic downturns, the threat of bankruptcy can cause sharp price declines, leading to a strong correlation with equities. This dual nature – part credit-risk asset, part interest-rate asset – gives high-yield bonds a unique role in a portfolio, offering higher income than traditional bonds but with a risk profile that is sensitive to economic growth. This explains why high-yield has avoided recent equity volatility; as they are senior to equity in the capital structure, the bonds can hold their value so long as default risk doesn't spike.

Key Takeaways:

- We maintain our risk estimates and long-horizon strategy, despite the current optimistic narrative around high-yield's current performance.

- High yield bonds can be subject to both stock and bond risks, although they have been largely insulated from both types of risk recently.

- Lower credit spreads leave little room for error against downside, implying lower allocations to high yield in an optimized portfolio

The market continues to value high yield. While many asset managers note the low credit spreads, current market sentiment towards high-yield bonds remains positive, driven by strong investor demand. This enthusiasm is largely a "search for yield" in an environment where duration exposure offers little upside due to a flat yield curve and substantial downside from inflation and sovereign debt concerns. Investors are accepting minimal compensation for credit risk as refinancing and leveraged loans hit record highs.

Furthermore, the market continues to expect a relatively benign economy with little recession risk, and a major wave of corporate defaults is unlikely to materialize. This narrative of economic resilience creates a feedback loop in which optimistic sentiment suppresses volatility, further reinforcing the perception that the asset class is safer than its historical record suggests/offers.