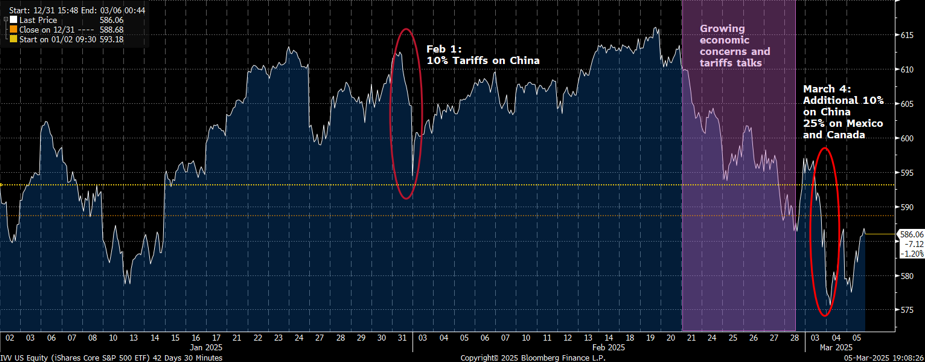

Markets have been volatile with a flood of news on the changing, and sometimes, escalating positions on tariffs. New Frontier’s investment committee discussed the impact, risks, and potential solutions to the current market environment.

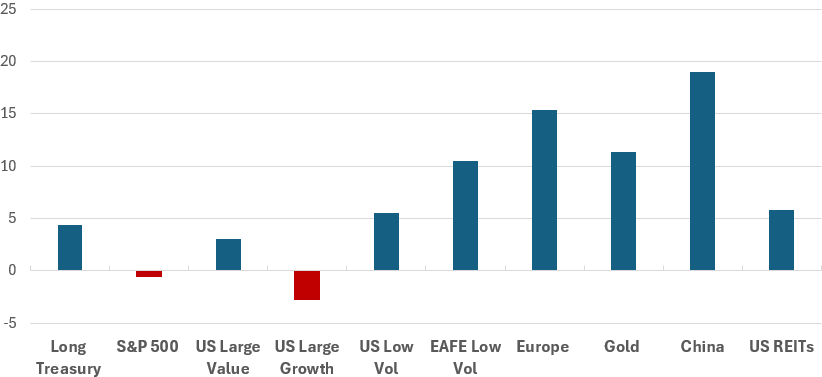

YTD ETF Return(%) as of March 5

Source: Bloomberg

- With today’s gains (March 5), stocks and bonds have had similar YTD returns: ACWI and Aggregate bonds are both up close to 2.5% (whereas S&P 500 is down 0.5%). New Frontier portfolios are correspondingly up over 2% across the risk spectrum.

- Markets don’t like uncertainty: Changing policies can lead to volatility as future expectations change for better or for worse. However, higher risk generally discourages investment, lowering asset values.

- Markets can still improve: while uncertainty and volatility are not positive for markets, the market declines are due to a lowering of expectations about the future, and not an immutable reality about the economy. Should conditions improve, markets are likely to respond positively (however, it’s possible conditions could further deteriorate). Markets do not know the future and therefore stocks are priced to compensate investors for the risk they take with their capital.

- Tariffs hurt market expectations: Economists have a strong consensus that tariffs slow economic growth through higher prices and lower overall global economic activity. This broadly hurts stock prices by lowering expected future profits of companies.

- Interest rates have fallen anticipating an economic slowdown: Lower economic growth due to tariffs increases the likelihood that the Fed will need to lower rates to encourage growth despite the potential of their inflationary effects. However, tariff policy will likely adapt should negative economic consequences become clear.

- Recently implemented tariffs were partially, but not fully expected by markets: Markets were uncertain that tariffs would be implemented – a pervasive theory suggested they were a bargaining chip and not intended to be implemented. Therefore, much of the effect of the recently imposed tariffs were already represented in lagging returns for U.S. stocks this year.

Market reaction to Tariffs YTD

Source: Bloomberg Finance

- Tariffs affected international markets according to relative expectations (though other factors also influenced returns):

- China: lower tariff than expected → market up 19% YTD

- Mexico: still open to negotiation → market up 9% YTD

- Canada: engaged in retaliatory tariff → market is flat YTD

- China: lower tariff than expected → market up 19% YTD