- Why it’s not surprising that the U.S. market is down.

- Diversification has been helping.

- The correlation between stocks and bonds is negative again… and it’s not good news.

The U.S. market fell 10%, but other markets have been positive. The U.S. market had a technical correction from its mid-February high. It’s never theoretically sound to predict markets will decline. After all, if there was reliable information that prices would fall, the market would have already adjusted them lower on that news. However, volatility can be predictable. A 10% market decline was so probable that our January markets webinar included “The market will experience a decline of at least 10%” in a list of predictions for 2025.

While the U.S. market is down, overall markets are healthy as international fixed income and alternative asset classes are providing return. Investors have transferred capital from highly valued technology companies to perceived undervalued assets elsewhere such as Europe and China. Europe gained 16% year-to-date, driven by fiscal stimulus and defense spending, while China rose 18% on AI enthusiasm and shifting sentiment. Gold surged 15% as a hedge and store of value. Min Vol equities also did well. Our optimally diversified portfolios benefited from avoiding overconcentration in just a few past winners and strategically sourcing diverse risk premiums.

Takeaway:

- Markets do not know what asset classes will perform best going forward. The negative returns of U.S. stocks and the exceptional positive returns of Europe, China, and gold are unlikely to continue in the future. Diversified exposure to regions and asset classes is prudent going forward.

- The primary goal for investors should be to efficiently capture market returns over time. New Frontier optimizes portfolios for this purpose.

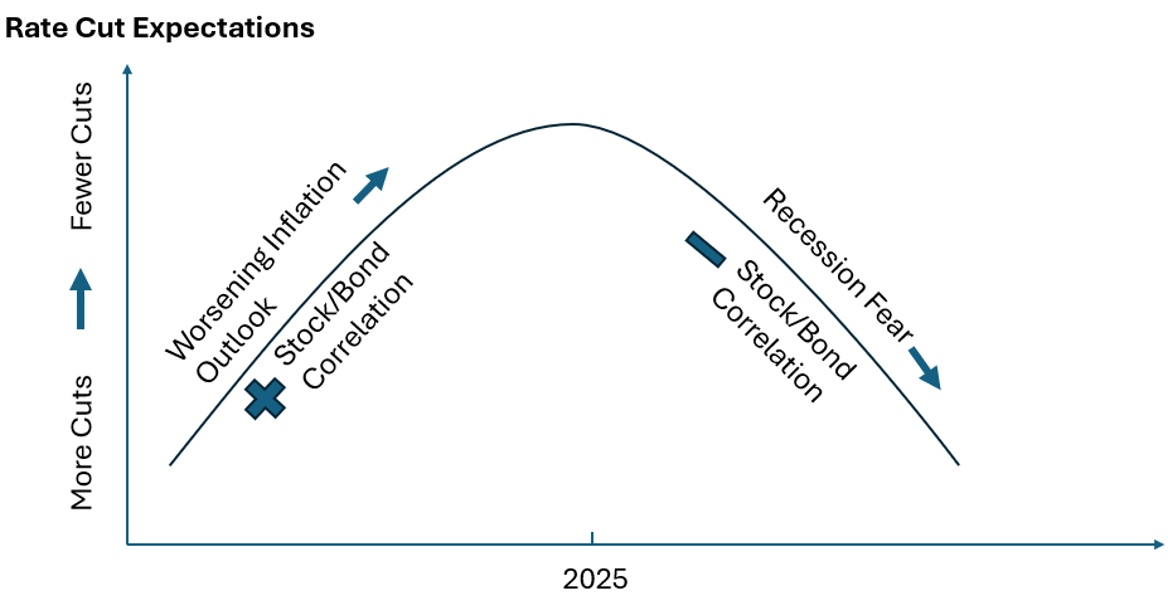

The market response to economic news has passed a turning point. For much of the past year, a strong economy was taken for granted, and therefore the market watched for continued declines in inflation statistics as indicators of Fed rate cuts. As the new administration’s policy focus on tariffs and tax cuts became a more likely outcome, hopes for lower inflation gave way to fears of a trade-war-induced recession.

The market reacts to the economic situation. If the economy remains strong and stable, then stocks and bonds may be positively correlated as good (bad) news about inflation will benefit (harm) both stocks and bonds. However, if inflation is unlikely to fall, then stocks and bonds may be negatively correlated as good (bad) news about the economy is good (bad) for stocks, but bad (good) for bonds as the Fed is more less (more) likely to lower rates to stimulate the economy.

Source: New Frontier

The future implication for your portfolio is not necessarily bad, however. The overall poorer economic outlook has already been priced into the market and was a major factor responsible for the recent decline of the U.S. market. Therefore, should economic news improve, U.S. stocks would benefit. However, it is still prudent to manage portfolio risk with broader equity diversification, in addition to using bonds to hedge equity risk.

Takeaways:

- Fed policy switched from hoping to lower rates, because it could, to being concerned about lowering rates… because it needs to.

- Broader equity and fixed income exposures should be used to manage heightened economic risk.