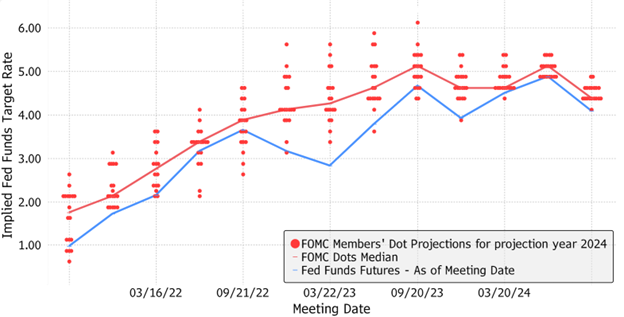

Markets have, once again, overestimated the rate cuts. We noted on September 16 ahead of the Federal Reserve meeting that market expectations of deep rate cuts remain highly uncertain. The past two years have repeatedly shown that markets can overreach in their forecasts, with predictions prone to dramatic shifts in response to new information. As seen in the chart above, markets have consistently anticipated more accommodated rate policies than the Federal Reserve's guidance at nearly every FOMC meeting over the past 2 years.

Since September 16, the market has had massive repricing: expected interest rates by the end of 2025, rose to 3.47% from 2.78%, effectively unwinding previously anticipated rate cuts by 70 basis points. 10-year Treasury yield rose by 58 basis points to 4.21%. This significant revision was driven by a series of economic indicators that exceeded expectations, including robust economic data, strong consumer consumption and steady unemployment rate at 4.1%, along with slightly higher-than-anticipated September inflation numbers.

Takeaway:

Acting on information that markets have already priced in regarding rate cuts offers little benefit and may backfire if those forecasts are overestimated. A more effective approach is to assess the varying risk and return characteristics of different bond allocations within an optimally diversified portfolio strategy.

Don’t bet on the U. S. presidential election. Neither side can obviously be forecasted to win, based on the available information from polls and prediction markets. The market has priced in available information regarding the impacts of policies such as debt, tariffs, tax, and infrastructure, but the election’s further impact on broad capital markets remains uncertain. While some investment performance may vary under different election outcomes, industry performance does not always conform to intuition: for example, wind and solar companies did quite well under Trump 2016 -2020, and coal did well under Biden. It will take time to see what policies will be implemented and for those policies to make an impact. Perhaps due to uncertainty about the future, gold has enjoyed a good ride recently as we await the final outcome of this important election cycle.

Takeways:

- The election is closely followed and priced into the market. Therefore, there is not much to gain from making risky bets.

- Knowing the election outcome doesn’t mean we know what will happen to markets – the economy and technological progress matter more to the evolution of markets.

- However, the risk and return relationships of asset classes should be reevaluated as reliable new information becomes available.