Despite continued geopolitical events and a potential banking crisis, markets remained focused on the economy and central banks’ attempts to control inflation. The quarter started with relative optimism after the lowered expectations of 2022 and nearly all asset classes fared well. Despite the failures of some midsized banks, and the buyout of Credit Suisse, markets have largely shrugged off the risk of further economic fallout from a broader banking crisis. The contractionary effect of the bank failures and the risk reduction of other banks may be more effective in reducing inflation than another rate hike.

Market Performance

The first quarter ended with positive returns for both stock and bond markets, despite a bank crisis that has led to tighter credit conditions and higher volatility. During the quarter, MSCI ACWI IMI and S&P 500 gained 6.95% and 7.5%, respectively, largely driven by U.S. tech stocks. Following one of the worst years for bonds in history, global bonds rose by 3.01% as bond yields fell on the back of changing expectations of economic growth and Federal Reserve’s policy.

Uncertainty reigned in the economic outlook and the future path for the Federal Reserve rate hikes. For example, market expectations for Fed policy at its upcoming May meeting reached a high of 5.36% on March 8 after stronger-than-expected jobs and inflation reports. Following the failure of Silicon Valley Bank rates fell below 5% by the end of the quarter.

International markets were mixed. European equities (+10.3%), Asia-Pacific equities (+5.4%) and Emerging Market (EM) equities (+4.5%), meant international equity market returns were overall on par with U.S. markets (+7.6%) this quarter.

Strategy Performance

All New Frontier’s ETF portfolios delivered positive returns in Q1, in line with broad markets. Global Core and Tax-Sensitive portfolio returns ranged from 3-6% depending on their risk level, and our multi-asset income portfolios gained around 2%. Relative to the benchmarks, the conservative portfolios performed better than more aggressive portfolios, benefiting from consistent exposure to duration and credit risk and being underweight in EM and REITs.

All fixed income ETFs we invest in had positive returns for the quarter. Due to a decline across the Treasury yield curve, long-duration bonds were the largest contributors to performance, especially U.S. long-term Treasury bonds. Investment-grade corporate bonds outperformed lower-quality bonds that saw tighter financial conditions.

Tech-led growth stocks rebounded for the first quarter after a brutal 2022, while value stocks underperformed growth by double digits, pulled down by financial stocks. Like value stocks, dividend stocks had an almost flat quarter, lagging the broad markets. Due to the ripple effects of the bank crisis resulting in concerns of credit crunch, REITs suffered and detracted from the portfolios performance. Gold increased by 8% during the turmoil, providing additional stability to the portfolios.

Model Reallocation

New Frontier rebalanced our Multi-Asset Income (MAI) portfolios on March 2 and our Core ETF portfolios on March 30. The inverted yield curve and elevated interest rate and credit risk resulted in a need to trade as measured by New Frontier’s patented portfolio optimality monitoring process. The optimized portfolios better balance between fixed income risk factors and include the addition of iShares Treasury Floating Rate Bond ETF (TFLO), which has among the highest yields currently available from the Treasury with the least risk of loss due to interest rate changes.

Optimal allocations to fixed income have lower duration due to the higher near-term yields of the currently inverted yield curve. This includes a major allocation to TFLO and corresponding reduction in short-term Treasurys. Additionally, we reduced exposure to mortgage-backed securities, which currently exhibit higher interest rate sensitivity since their duration increases as mortgage prepayments have decreased. Credit exposure shifted from investment grade to high yield fixed income. Among equities in core portfolios, there was a small shift to small cap, value, and min vol.

MAI portfolios further optimized income, eliminating the allocation to international REITs, which have become unreliable sources of income, and increased allocation to more reliable income from U.S. dividend equities and U.S. REITs. Current yield across MAI portfolios is approximately 5% after the rebalance.

New Frontier uses the Michaud-Esch portfolio rebalance test to guide portfolio reallocation and rebalancing decisions. This framework allows us to simultaneously consider changes to the risk characteristics of portfolios from price movements, and changes to optimal portfolio exposures from new capital market expectations. Tax-sensitive ETF models were rebalanced last quarter and remain statistically intact for their investment objectives.

Investment Themes

Markets consider events of the quarter relative to expectations. There was little good news, but expectations in 2022 were sufficiently low that anything short of a full recession could be seen as good news, relatively speaking, and therefore lead to positive market returns.

Although daily interest rate volatility has been high, and extraordinary for horizons of 1-3 years, duration risk is lower than in 2022. At the same time, bonds with credit risk would likely suffer in an economic slowdown. This means that a more balanced exposure to credit and duration is currently optimal for most investment purposes than in the recent past.

Treasury Floating Rate Notes (FRNs) have been available as an ETF since they were first issued by the Treasury in 2014 but have not been included in our optimized portfolios until this quarter. With much higher interest rates and elevated risks from other asset classes, a very low risk, moderate return asset can improve the risk-adjusted return of an optimized portfolio. Treasury Bills and investment grade FRNs are also available in well-managed ETFs, but compared to T-Bills, FRNs have slightly lower interest rate sensitivity since they reset every week instead of 3-months, and currently have a 20bp premium from the Treasury. Compared to investment grade FRNs, Treasury FRNs have only slightly lower income, but are lower risk and exempt from state income tax. Finally, should interest rates fall or FRNs lose their desirability in a portfolio, they can easily be sold from the portfolio as they are highly liquid and have little potential for capital gains from price appreciation.

While these characteristics make Treasury FRNs an alternative to cash in personal banking, they’re even more useful in a portfolio. Given that a recession is still possible, balancing risks and accepting higher return from yield curve is the right answer for now.

The Problem with Banks

When central banks raised interest rates to battle inflation, fixed income markets were affected directly through lower prices, and equity markets were affected indirectly through lower expectations for economic growth. Contained collateral damage is part of the plan to fight inflation by slowing down the economy. It should be no surprise to see companies reduce investment, lay off workers, or even fail.

Banks, in particular, are susceptible to rate volatility. Reminiscent of the 1980s Savings and Loan crisis, rising rates caused bank failures when banks were not able to generate enough income from their assets to pay competitive rates for depositors. Unlike the S&L crisis, the assets are not limited to loans, but the investment portfolio of the banks. Investors familiar with asset returns from 2022 should not be surprised to see a shortfall.

The banking crisis is not currently a major concern for depositors. The Fed, FDIC, and Treasury banded together to ensure accounts and depositors are not panicking. But a fundamental problem remains—many banks considered to be fully solvent and low risk continue to offer savings rates far below Treasury Bills. Depositors have the incentive of much higher rates to transfer their savings accounts to money market funds, or even better, risk-free Treasury Bills or Floating Rate Notes. Treasurys are also exempt from state income tax, further increasing their effective interest rate for most investors. Much of the profitability of the banking system is based on depositors being content with below market rates. Banks with below market assets will be fine as long as their depositors are complacent, but this is not self-reinforcing.

The efficiency of one’s cash savings is a reminder to consider investment optimality from a broader portfolio perspective rather than in isolation. An investor with a significant cash allocation would likely be better off bringing the cash into their investment portfolio and managing the entire portfolio for their investment goals. Historically, convenience was a barrier to portfolio optimality, but technology has made transfers and cash management accessible enough to consider a better solution. Thinking holistically can improve outcomes compared to considering only a small part of the investment picture at a time.

The Economy

The damage from higher interest rates is a reminder that disrupting any economic equilibrium can be painful. Inflation, for example, is most harmful when it’s unpredictable because it forces readjustment. Resetting prices, wages, and supply cost expectations are all complex business calculations, each with an associated risk to the business if miscalculated. This forces businesses to lower investment and increase price buffers—the price businesses need to charge to ensure a profit due to the volatile and variable unknown future costs to avoid the risk of operating at a loss. This slows growth and reduces overall welfare. Similarly, bank failures and interest rate uncertainty lead to causal chains that ultimately harm the economy.

The Fed

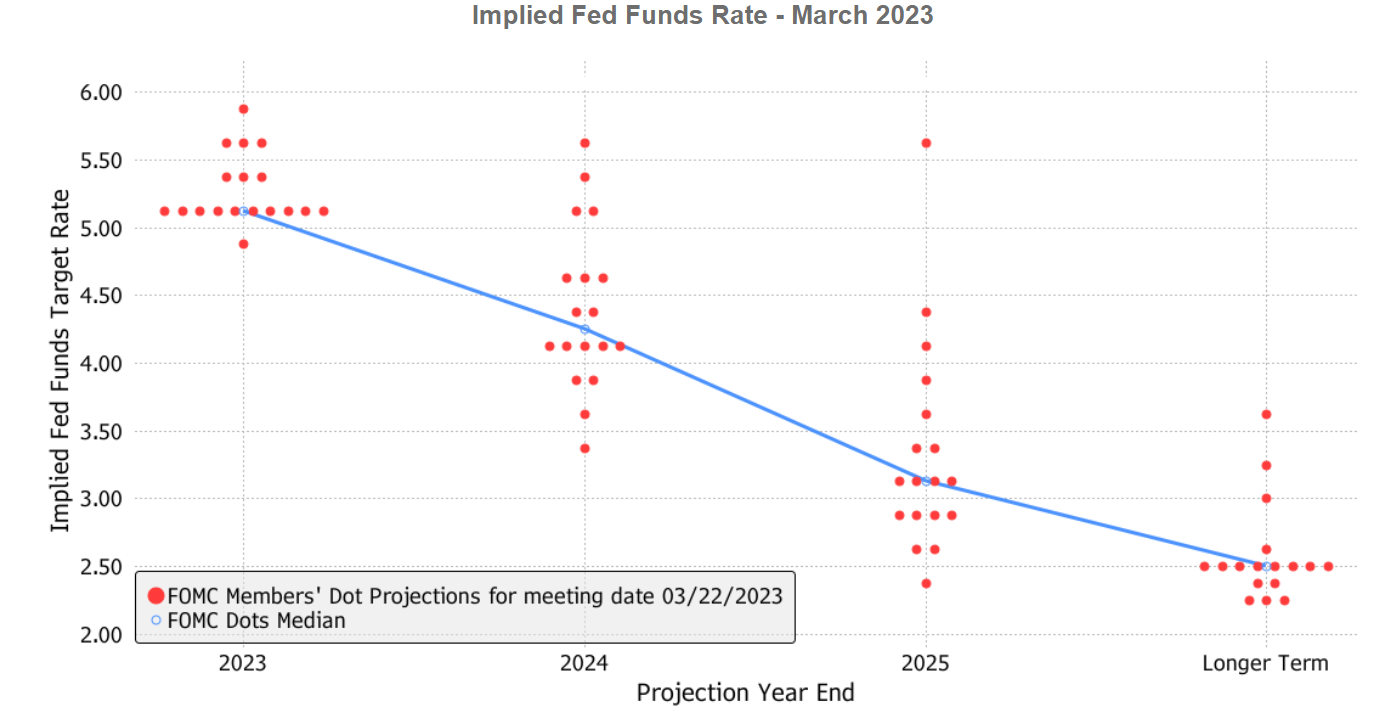

Markets are predicting end of rate increases and possible rate cuts before the end of the year. The Fed is firm that the year will end with rates even higher. It’s rare for the Fed and markets to disagree as much as they currently do. The Fed expects rates to be higher now and lower in the future, whereas the market is the opposite (although they approximately agree 3 years out). The Fed “dot plot” shows rates above 5% at the end of 2023. This is close to a full percentage point higher than the yield curve implied forward rate.

The yield curve shows the current market price of future safe assets. As always, market prices are a complex equilibrium from many investors. Market prices do not represent a belief in a single scenario, but rather an average of many expectations and preferences. Low yields in the future may be due to investors expecting to profit from those positions or others looking to hedge risks in the future. Therefore, much of the market either expects recession or is worried enough about the possibility that they're willing to accept lower rates in the future than the Fed expects to provide.

Source: Bloomberg

Other Themes

- China continued to consolidate power in President Xi, but a more realistic post-pandemic reopening will contribute to GDP.

- Europe also improved its growth outlook.

- Artificial Intelligence will be a productivity boost in the long term, more than offsetting lost labor from the pandemic and demographic issues across the developed world.

- A shift to greener energy sources means oil companies are incented to invest less. Opening the Alaska National Wildlife Refuge, for example, may not result in more oil being produced since the cost of extraction is estimated to be the same as current prices. A profit seeking company may prefer to distribute profits rather than invest in unprofitable growth.

- The debt ceiling will likely come up for debate. A potential Treasury default is an odd risk for investors, since it calls into question the safety of the “risk-free” asset. In prior similar situations, Treasurys were paradoxically the best performing asset, and the best advice was to make sure you had a well-diversified portfolio of the appropriate risk level.

Link to Author Bio

Robert Michaud