Is 4% a Safe Retirement Withdrawal Rate?

Retirement is fraught with uncertainty. Individuals approaching retirement face a variety of questions regarding their families, their health, and long-term market uncertainty. Financial planners must answer questions from clients seeking guidance and hoping to establish a secure financial cushion for their later years. One common question is, "how much do I need saved at retirement to maintain my current level of inflation-adjusted income"? Another is, "assuming I have my current wealth saved at retirement, what level of inflation-adjusted income could I maintain"? Clearly these considerations alone cannot constitute a complete plan for embarking on and living well through retirement. Yet they form a natural starting point for conversations with a financial planner.

Consulting historical data on bond and equity market returns, some planners have attempted to calculate the maximum level of constant inflation-adjusted annual withdrawals that could have been sustained over any, or just about any, recorded 30-year retirement window, as a fraction of the initial investment funding it. Analyzing the available data, they have often found that this "Sustainable Withdrawal Rate" (SWR) is some number on the order of 4% and is achieved with a portfolio containing some balance of stocks and bonds. However, markets are often unpredictable, so no figure can be considered "safe" with absolute certainty. Moreover, available historical data is limited, so as new market data is recorded, these same planners have revised and re-revised their advice. So, what do we really know?

At New Frontier we design, provide, and utilize advanced statistical methods for investment management and to aid in financial planning. One of the hallmarks of sound statistical practice is the modeling and measurement of uncertainty. So, while no fixed strategy can guarantee success with 100% certainty, one might find that a given retirement funding strategy works for 95% of market scenarios, based on statistical models incorporating nearly 100 years of stock and bond returns, volatilities, correlations, and inflation. This allows for realistic planning advice which expresses a high degree of confidence rather than absolute certainty. Also, the level of portfolio risk can be adjusted to maximize the recommended SWR for a given confidence level of sustaining the withdrawal over the retirement horizon. The resulting plan and outcome scenarios can then be cross-referenced with actuarial probabilities of health or other calamities in order to help the client get a feel for the relative likelihoods of various scenarios.

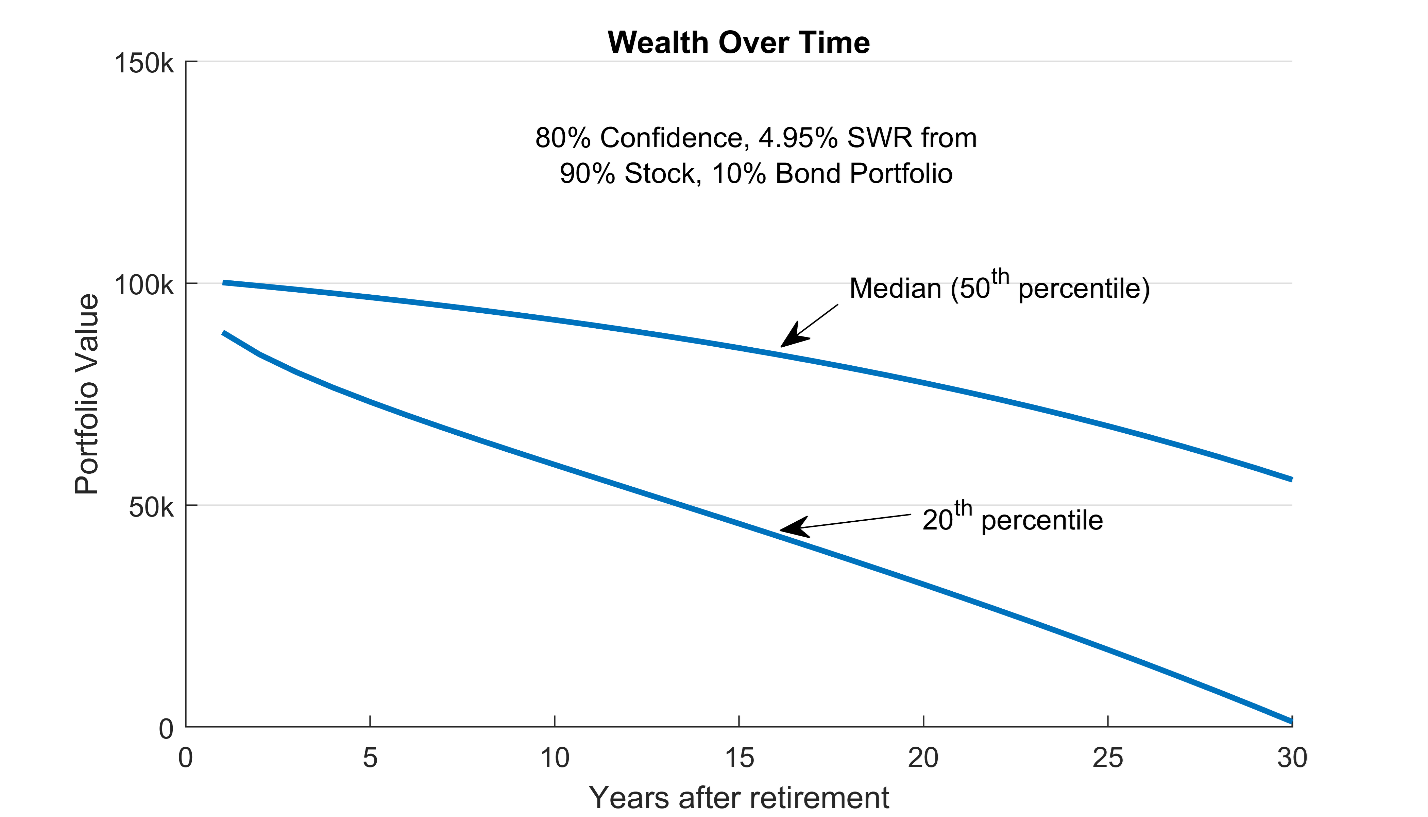

We find that for a 30-year retirement horizon, with, say, an 80% confidence of being able to sustain withdrawals, a 4.95% SWR is the highest level of withdrawals that can be recommended, achieved by an aggressive (90% stocks, 10% bonds) portfolio (see Figure 1). This might be appropriate for clients who are looking to formulate a general guidance plan with a given funding source, but have other backup sources or lifestyle alternatives in case depletion of the primary source does seem to be at risk – and who may seek a high potential for capital appreciation in order to leave a generous gift for their heirs.

Figure 1

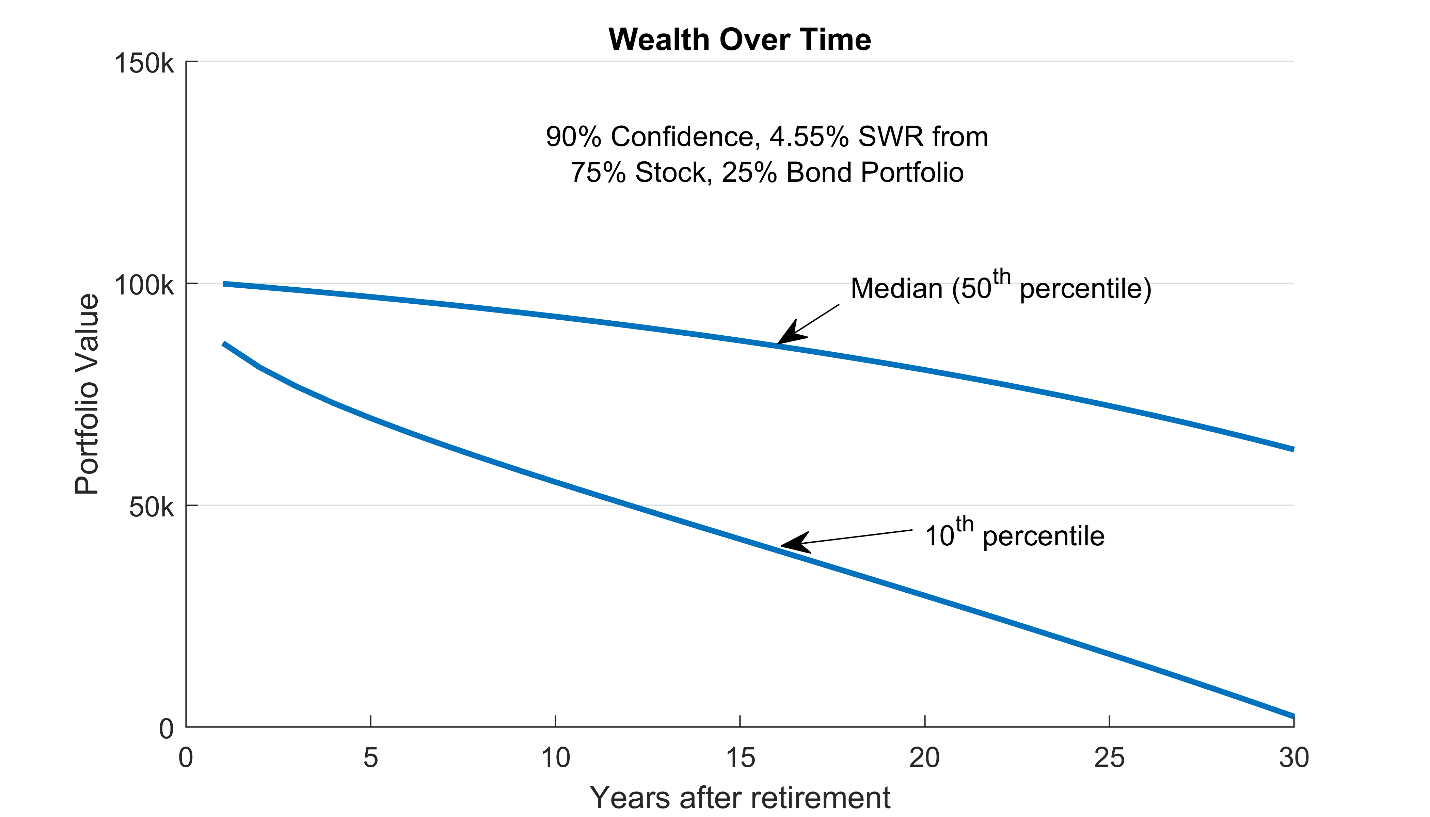

For clients who seek more confidence, say 90%, that their savings can fund a 30-year retirement, we find a 4.55% SWR is the highest that can be recommended, achieved using a portfolio consisting of 75% stocks and 25% bonds (see Figure 2). However, for those seeking near certainty, at a 99% level of confidence, that they will not deplete their retirement fund within 30 years, we find that an SWR no higher than 3.7% can be recommended, achieved using a balanced portfolio maintaining a 60/40 stock/bond mix. From that perspective we feel 4-5 percent withdrawal rates should be recommended for a 30-year retirement horizon only with full understanding by the client that in the rather unlikely worst-case scenario, they may well need to adjust course or consider lifestyle changes during retirement or rely on support from others.

Figure 2

On the other hand, if a shorter horizon is appropriate, say 20 years, we find that with 99% confidence of success, a 5.1% SWR can be recommended, achieved using a moderate portfolio of 40% stocks and 60% bonds. As in all of our examples, this 5.1% represents an average inflation-adjusted figure, which means the withdrawals are assumed to actually increase over time, keeping pace with historical inflation rather than maintaining a constant nominal dollar amount.

The conversation about a sustainable withdrawal rate is only a starting point and a rule of thumb for developing and maintaining a sound financial plan through retirement. Every retirement is unique and circumstances may always change in unforeseen ways. Markets are uncertain and no retirement plan is 100% foolproof. Since inflation is a near-certainty over the duration of a typical retirement, sitting on cash is rarely a prudent investment strategy for maintaining one's lifestyle after retirement. The highest rate of inflation-adjusted withdrawals one might use as a starting point for a sustainable retirement plan, and the particular stock/bond mix needed in order to achieve it, depend on both the degree of certainty and the retirement horizon appropriate for the client.

Disclosures:

New Frontier Advisors LLC (“New Frontier”) is a federally registered investment adviser based in Boston, MA. The information discussed here is for information purposes only. Past performance does not guarantee future results. As market conditions fluctuate, the investment return and principal value of any investment will change. Diversification may not protect against market risk. There are risks involved with investing, including possible loss of principal. Before investing in any investment portfolio, the investor and Financial Advisor should carefully consider the investor’s investment objectives, time horizon, risk tolerance, and fees.