Inflections Over Elections

Inflation is tempering, and the economy is gradually slowing, but AI fueled stock returns have pushed markets to new highs. The question remains how much longer can a concentrated market outperform more diversified markets with potentially better value. The strong dollar and uncertainty about future interest rates and long-term inflation are further causes for concern. It’s time for a reflection on some of history’s market inflection points as we consider how to optimally diversify our portfolios.

Markets

Market Performance

Markets reached all-time highs in the second quarter of 2024, despite some turbulence. Sticky inflation concerns in April gave way to optimism as inflation data improved in May and June, making a September rate cut more likely. These factors drove stocks higher from April losses, leading to solid quarterly gains. The MSCI ACWI IMI index rose 2.4% (11.7% YTD), and the S&P 500 gained 4.3% this quarter (15.2% YTD).

In the U.S., equity returns were concentrated in big tech companies, driven by AI and strong earnings that consistently beat expectations. This led to dominance of growth stocks, where value stocks were flat, and small cap and REITs struggled.

Geographically, developed international equities underperformed compared to the U.S., partially driven by the higher dollar. Asia-Pacific, after leading the first quarter, was down 2% this quarter, impacted by the historically low yen. European equities were flat representing a 0.48% gain. Emerging Markets rebounded from first quarter’s losses, outperforming U.S. and developed markets with a 4.8% increase, bolstered by China.

The bond market experienced volatility throughout the quarter but ultimately ended close to where it began with U.S. aggregate bonds returning 0.03%. The 10-year Treasury yield ended at 4.36% after peaking in April, up 16 basis points from Q1 and 41 basis points this year. High-yield bonds saw an increase of roughly 1%, supported by solid earnings. The 3-month T-bill remained one of the best-performing bonds this quarter, with a return of 1.29%.

Strategy Performance

New Frontier's ETF portfolios delivered strong returns across the board this quarter. Equity allocations drove absolute returns, while bond allocations boosted relative performance.

For Global Core, Treasury floating rate bonds and gold contributed to relative performance. However, the portfolios' lower weight in large-cap growth stocks offset the benefits from bond allocations and global diversification. Additionally, positions in small-cap stocks and REITs detracted from relative performance.

Tax-Sensitive portfolios largely mirrored the performance of Global Core. While municipal bonds underperformed their taxable counterparts, relatively higher allocations to tax-efficient assets like growth stocks helped boost the overall returns.

Multi-Asset Income (MAI) portfolios experienced a flat quarter, as dividend stocks lagged the broader market. However, the newly added S&P 500 covered call ETF and Emerging Market high-dividend stocks contributed positively to relative performance. Currently, MAI portfolios offer attractive SEC yields around 5%.

Model Reallocations

New Frontier rebalanced the Multi-Asset Income (MAI) ETF portfolios on May 9.

Reasons for Rebalance:

- Changes in the market environment: higher short-term yields, inflation and mortgage dynamics, and lower credit spreads

- Asset weight drift from price changes

- Opportunities in new ETFs: covered call ETFs

Reallocations:

- Increased exposure to short term bonds

- Lower TIPS exposure

- More mortgages

- New allocation to covered call ETF

- Additional US and International dividend ETFs

Consequences:

- Lower expected portfolio volatility

- Higher expected portfolio yield

- Slightly lower duration

New Frontier uses Intelligent RebalancingTM, the Michaud-Esch portfolio rebalance test, to guide portfolio reallocation and rebalancing decisions. This framework allows us to simultaneously consider changes to the risk characteristics of portfolios from price movements, and changes to optimal portfolio exposures from new capital market expectations.

ETF Additions:

iShares S&P 500 BuyWrite ETF (IVVW). This ETF holds the S&P 500 stocks and generates income from selling covered calls. It is therefore expected to produce substantial income with less volatility than standard equity ETFs. The ETF has the additional benefit of generating income without additional exposure to dividend paying sectors or risk factors, thereby improving portfolio diversification. There are many new options-income ETFs to choose from and IVVW was selected based on its broad and understandable exposure, efficient options strategy, and low expense ratio (0.25%). Despite these desirable properties, New Frontier determined the optimal allocation to be 1% to 2.7% (higher allocations in more conservative portfolios) due to low total return intrinsic to “buy write” funds.

Schwab US Dividend Equity ETF (SCHD) and Vanguard International High Dividend Yield ETF (VYMI). These liquid and low expense ratio ETFs (0.06% for SCHD and 0.22% for VYMI) feature distinct but thoughtful dividend selection methodologies. Dividend exposure varies across ETFs and portfolio risk can be better managed with a range of dividend styles available from multiple fund families.

The Future of Diversification: Asset Class Insights

Large Cap and AI Concentration

Markets have been dominated by an increasingly narrow focus—admittedly on what may prove to be one of the most impactful and revolutionary technological advances in modern times. Just like with the internet, markets can be both right and massively wrong at the same time—the internet has produced immense value, changed our lives and the global economy yet misguided investors who experienced losses that took years to recover from.

- The Magnificent 7 stocks have higher weight in global stock indices than the 7 largest countries outside the U.S. combined (e.g., MSCI ACWI)

- Nvidia has larger weight in the global stock indices than any country other than Japan.

Asset managers explaining concentration risk can sound like an excuse for missing out on spectacular returns from a few stocks, but managing risk in a portfolio tends to be more productive for maintaining and growing wealth over time than investing in concentrated stock positions.

Small Cap and Private Equity

Small cap stocks have underperformed large cap stocks over the last 10 years, but according to most financial theory, they should have greater return on average to compensate for their higher risk (Fama and French (1992) calculate a premium as high as 7.2% per year. Historically, the premium is 1.7% from 1926-2022, according to the SBBI data set).

One explanation is the smaller pool of available stocks. Since the Philadelphia Stock Exchange opened in 1790, the number of publicly listed companies in the US has trended upward until peaking in 1996. Today, there are barely half as many (from 8,090 in 1996 to about 4,300 in 2023).* This drop is attributed to greater private equity ownership (interestingly, both AssetMark and Envestnet started the year as public companies and will end as 2024 private), as well as greater mergers and acquisitions activity by large companies.

Private equity returns are widely dispersed and typically highly leveraged, and therefore a misleading comparison. Intuitively, private equity firms are no better at picking winning companies than active managers, so we should expect little impact on the overall investment value of public small caps when privately held firms are excluded. Whoever the buyer, buyouts of small cap companies are generally at a premium to what the public market would otherwise pay, and therefore contribute to the return of public small cap stocks.

A more plausible explanation for a reduced small cap premium is investment advances. Information is more accessible today than in the past, reducing the risk of investing in smaller companies. Trading costs are much lower, liquidity is much higher, and broad baskets of stocks are cheaply available to investors. These imply lower outperformance going forward. However, a basic competitive market, valuations, and an understanding that investors need to be compensated for risk suggest smaller stocks should have at least as high average returns as larger stocks.

*Source: FRED and CNN.com

International and Emerging

Emerging markets have also not met expectations over the last 10 years even though their economies have largely prospered over this time period. While there will likely continue to be a lesser relationship between economic growth and investor returns in emerging markets compared to developed (due to regulation, government ownership, and less cultural responsibility to shareholders), emerging markets may have improved opportunities due to composition and valuation.

The emerging markets had been dominated by China, with China making up nearly 40% of the index as recently as 2021. With the decline of the China market and the rise of India, China and India now are roughly 22% and 20% of emerging markets. Additionally, as China and India compete on the global economic stage from a different political, cultural, and industrial perspective, there is reason to expect lower correlations between their markets. The broader exposure and better diversification may result in better risk and return characteristics for EM ETFs going forward.

Real Estate

Real estate is a moderate risk, moderate return asset class that balances both stocks and bonds in a long-term portfolio. The world’s wealth is very roughly stored in equal parts, stocks, bonds, and real estate. Real estate was hurt first by a worse than expected decline in demand for office space following the pandemic, then a longer than expected period of high interest rates. If these negative events are priced in, real estate should reclaim its role as a useful hybrid asset class.

Value and Momentum

Value has long been a foundational principle of investing. The adage “buy low and sell high” as well as wisdom of influential investors (e.g., Warren Buffet) support value investing. In contrast, momentum investing buys into price increases in the implicit hope that the higher price is informative and the expectation that the trend will continue.

In the context of consistent investment themes for the last six quarters, it is no surprise that momentum has performed extremely well (momentum investors should be cautious of two risks which have not recently appeared: failing to capture the market’s momentum, which has been low due to six quarters of large tech momentum; and the potential for high downside when the market turns). Value, however, is fundamentally better aligned with long-term investing and wealth appreciation, although it is less likely to exhibit spectacular returns.

Insights

Market Mistakes

Markets rapidly incorporate information into prices. For example, economic data, corporate earnings, and statements from Fed officials have an immediate visible impact, and there is little to gain from reacting to, or even anticipating news. However, this information is priced into the market from a perspective, and that perspective can be misguided.

There are many examples where, in hindsight, one can clearly see “irrational exuberance” and excessive allocation to capital for the internet, even though they reflect a reasonable concern or investment hypothesis at the time. Examples include:

- Dot-com bubble: irrational exuberance and efficient use of capital

- 2008 Financial Crisis: ignoring systemic risks

- 2009 Recovery: reluctance to deploy capital

- 2022 Fed rate hikes: bond market complacency

Long Term Returns

Although some asset classes have dramatically outperformed others, over the last 10 years there have been almost no absolute losers—among the ETFs we invest in, only international treasuries have had negative returns over that period, due to low rates and the rise of the dollar. The conclusion is that strategies that invest in markets over time tend to provide wealth appreciation and protection to investors.

Fed Watch

Markets are still focused on anticipating Fed policy and therefore, inflation and economic news move markets. Markets rose moderately and rates fell sharply when inflation readings came in 0.1% lower than already low expectations, bringing CPI down to 3.0%. The cumulative effect of the news, which has been in the right direction more often than not, is close to pushing the Fed to start loosening monetary policy.

Elections and Market Returns

Markets are famously heartless. An election may result in some volatility, especially for an unexpected outcome, but the impact is often muted. For example, of the four major elections this quarter—Mexico, India, France, and the UK—only Mexico’s election appears to have moved markets.

Source: Bloomberg

In the U.S. we also see little pattern in the outcome of a presidential election

Source: Bloomberg

Implications of Market Highs

Most equity indices achieved all-time highs near the end of the quarter, as did New Frontier indices (all risk levels for both U.S. and Global)**. From history, we know that market highs are not a reason to change investment plans, as forward returns tend to be at least as positive when starting from a market high as otherwise, what goes up might not come down.

**Source: S&P Indices

The Fed and Rates

Source: U.S. Department of The Treasury

Comparing the yield curve at the end of this quarter (blue) to the last quarter (red), we see modest increases in longer-term rates, although less than in the first quarter. There is little change in the short end of the yield curve. This matches what we’ve seen in interest rate volatility, which has been low for short-term bonds as there have been no changes to interest rate policy, but higher for longer terms as expectations about future rate policy changes.

Fixed Income Volatility

Short-term volatility has been low due to no changes in the policy rate. Other rates are clearly more volatile than they were in the calm decade before the Fed began raising rates (2012-2021), but are close to longer term norms of a mixed environment. Compared to longer-term observations over 2004-2023, we see two- to ten-year rates were only slightly more volatile last quarter, whereas the volatility of 20- and 30- year rates were practically identical to their longer term average.

Source: U.S. Department of The Treasury

The Economy

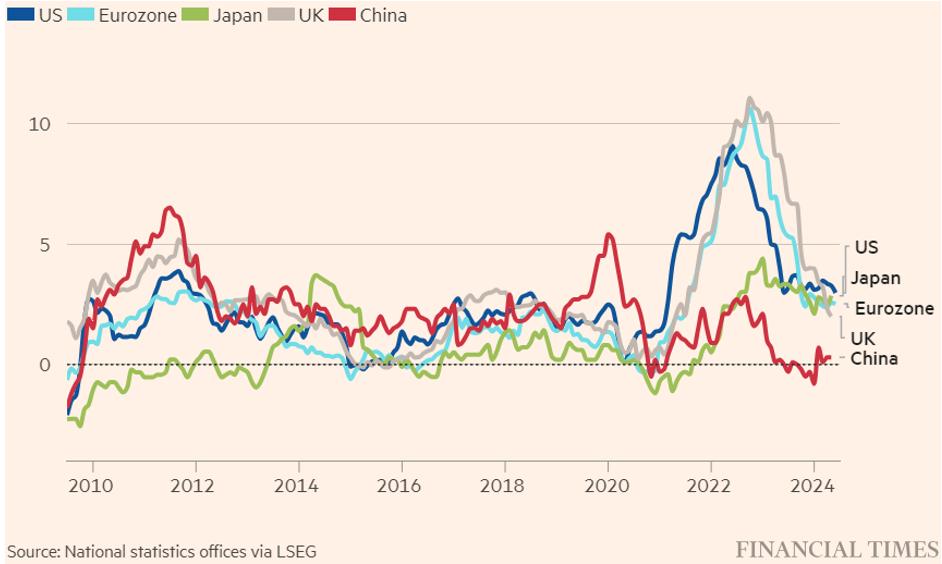

Concern that inflation will plateau before reaching target levels of 2% is giving way to early indicators of economic slowdown. With U.S. inflation rates falling to 3%, inflation rates in major developed markets are now between 2 and 3 percent and still trending downward. While this is little consolation to consumers suffering from reduced purchasing power over the last three years, this is good news for the Fed, as it may soon be able to shift its focus from fighting inflation to supporting a healthy labor market–good news for the economy and markets long term.

CPI as of 06/2024 for US and Eurozone, Japan, UK, and China as of 05/24.

Other Insights

- The Dollar appreciated 1.3% this quarter and remains historically high. It is our view that currency risk is symmetric, meaning it could decline as quickly as it rose, affecting the returns of international equities.

- Bitcoin returns cooled this quarter after a fast start on the launch of the ETF. The question of how or if to use Bitcoin in a portfolio remains open.

- Active ETFs continue to gain assets with the popularity of mutual fund conversions and options enhanced funds. These are not harmful to markets as conversions move investors to a preferred fund structure, and ETFs continue to evolve.

- Isolationist politics: a potential shift towards greater isolation for the U.S. could make international diversification more valuable since the reduced economic correlation could lead to financial markets decoupling as well.

Conclusions

Inflation is slowing and though the risk of economic slowdown should never be ignored, most economic indicators remain fairly strong. It’s therefore no coincidence that the U.S. also has among the highest interest rates, strongest currencies, and highest valuations for its corporations. The market knows this, of course.

In hindsight, the market environment has been remarkably consistent for the last six quarters—massive enthusiasm and investment in AI amid consistent economic growth, robust employment, and a sharply inverted yield curve as the Fed slowly battles inflation.

Though the general landscape remains superficially similar with steady economic growth and technology investment likely to continue for some time, markets will eventually adjust. Investors tend to focus on a small number of themes at a time and move markets according to how they fare. Though there is still a focus on inflation, the Fed, and AI, when we ultimately move to a new market regime, markets will likely revert to a more normal level of sensitivity to economic news as they change their lens.

DISCLOSURES: Past performance does not guarantee future results. As market conditions fluctuate, the investment return and principal value of any investment will change. Diversification may not protect against market risk. There are risks involved with investing, including loss of principal.