Asset Allocation System

The New Frontier Asset Allocation System is a comprehensive solution for institutional quality portfolio management and investment decision making. Founded on New Frontier's patented Michaud optimization and Michaud-Esch Rebalancing, the System adds investment tools developed from statistical science, investment experience, modern financial theory, and proprietary research. It creates sensible, effectively diversified portfolios with the most advanced risk management technology available today while supporting the practical needs of investment managers. Our investment committee uses the System to create our own investment products.

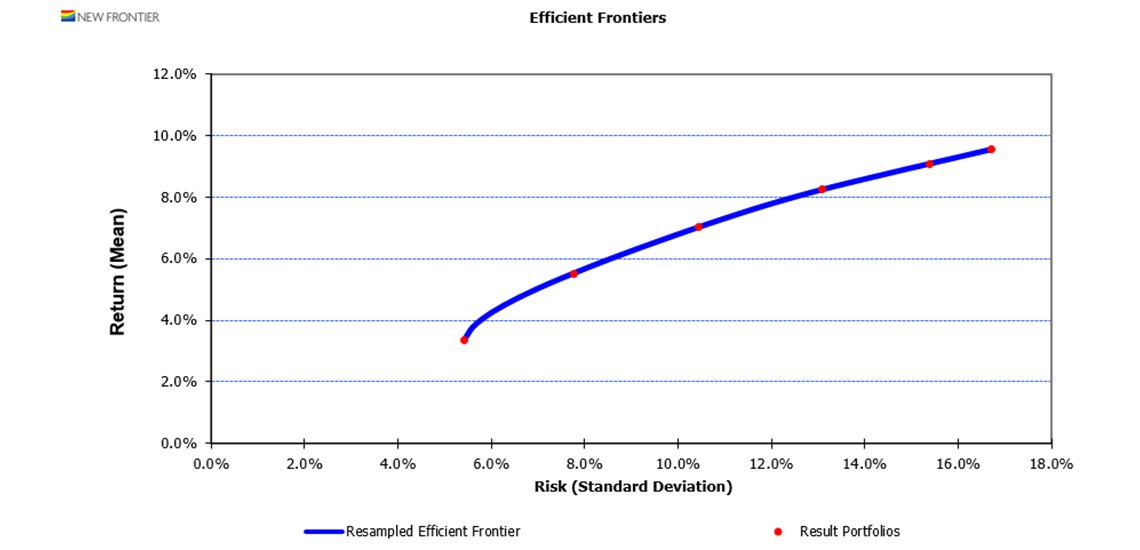

The Estimator develops realistic risk and return inputs with state-of-the-art statistical methods, and the Optimizer computes the efficient frontier using Michaud optimization. Optional modules provide guidance about when and how to trade, project long-term outcomes of investment decisions, and increase computational efficiency.

Features

- Advanced statistical estimation – maximum likelihood missing data analysis, investor views and Bayesian priors, group estimation with hierarchical modeling and noise reduction

- Advanced optimization options: long-short, tax sensitive, benchmark relative, non-normal resampling, options modeling, a complete set of optimization constraints (transaction costs, risk penalties, etc.), custom return distribution characteristics and scenario/simulation management

- Visual and numerical tools for selecting specific frontier portfolios, determining asset significance, assessing portfolio health, and analyzing constraints

- Numerous charts and reporting options for validation and presentation

- Distributed processing configurations to speed compute-intensive calculations

- Investability and liquidity tools for trading practicalities

- Complete process automation suitable for daily monitoring of portfolios

- LifeCycle analysis for risk profile choice matched to clients' objectives