New Frontier Indices React to News in Real-Time

Capital markets are known to react strongly to breaking news. Often the impact of such events does not meaningfully reach portfolios in which institutions and individuals typically invest. So where can investors turn for real-time information on risk-targeted portfolios’ reaction to market events? New Frontier’s family of optimized indices are designed to provide transparency into the performance of our multi-patented investment strategies.

New Frontier Indices are constructed in the same way as our ETF strategies; they are the most transparent representation of our investment process in real-time. Consider a recent example.

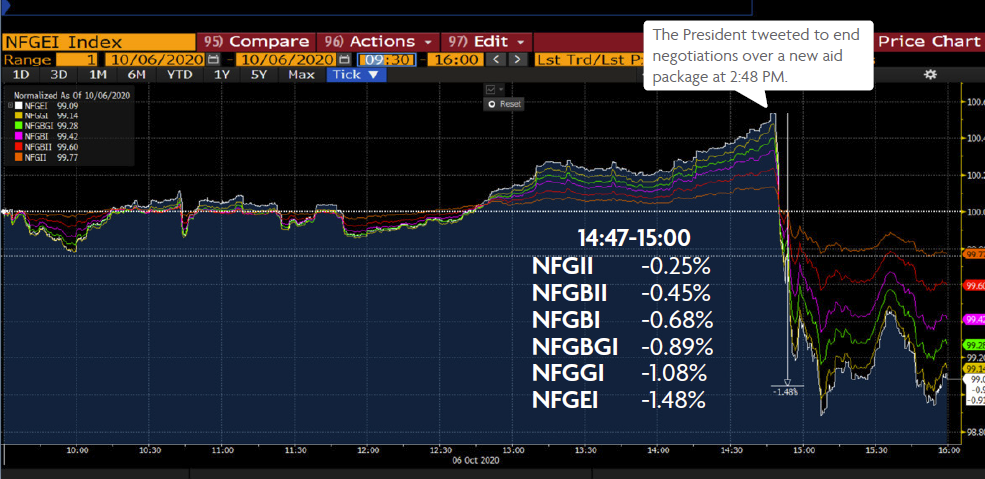

Last week on October 6 markets were initially responding positively in anticipation of a bi-partisan stimulus plan. At 2:48 PM, stocks dropped sharply after President Trump tweeted that he would reject a $2.4 trillion stimulus proposal and end negotiations over a new aid package for those impacted by the COVID-19 pandemic. The Dow Jones Industrial Average fell over 300 points and the intraday high-to-low swung over 628 points. The S&P 500 fell 1.4% and the markets saw a sharp reversal in other major indices.

For most institutions and individuals, the impact on the kinds of risk-targeted portfolios in which they invest was far less dramatic, as was the case with our indices. New Frontier’s indices, which span the spectrum of long-term systematic risk ranging from 20/80 to 100% equity stock/bond ratio, are a case in point. Our indices dropped .25% in the most conservative index, NFGII, and -1.48% in our most aggressive index, NFGEI, as reflected in the chart below.

Source: Bloomberg

Since then, our six strategic-risk-level optimized global indices rebounded as have our two U.S. indices. These U.S. dollar denominated indices are accessible in real-time across many digital platforms including Bloomberg and S&P’s professional services; New Frontier’s website; smartphone stocks apps; Yahoo Finance, and on wearable devices like the Apple Watch for ease of use and monitoring.

Index performance, as calculated by S&P Dow Jones Indices, is based on the nearly 16-year history of New Frontier’s global ETF portfolio management performance in index form.

New Frontier Optimized Indices employ Michaud optimization for index construction. The patented optimization process is designed to more realistically address uncertainty endemic in investment information.

The indices are a proof-of-concept in practice for New Frontier’s multi-patented Michaud optimizer and investment management technologies, offering transparency into our investment process, and demonstrating our commitment to continuous innovation in investment technology for enhanced asset management.

For more information on the investment approach behind the indices, visit the “Our Process” section of FrontierAdvisor™.

Disclosures: New Frontier Advisors LLC (“New Frontier”) is a federally registered investment adviser based in Boston, MA. The information discussed here is for information purposes only. Past performance does not guarantee future results. As market conditions fluctuate, the investment return and principal value of any investment will change. Diversification may not protect against market risk. There are risks involved with investing, including possible loss of principal. Performance of New Frontier Global Index returns is calculated by S&P Dow Jones Indices and does not include trading costs or advisor fees.

Need more information?

Contact us to find out how we can work with you.