Q4 2021 Market Perspectives: "Tracking the Recovery: Inflationary Pressure a Symptom Not the Cause"

The year ended on a highly upbeat tone for investors as equities rose to new heights against a backdrop of inflation and a prolonged pandemic. This marked the acceleration of many market and economic trends for the year including the dominance of U.S. large-cap stocks, the rebound in sectors such as real estate inflationary pressures, a return to full employment, and a broad move toward the post-pandemic economy. So, while inflation dominated the narrative for the quarter, it is a symptom of other global economic issues rather than the underlying cause.

Market Performance

Amid continued uncertainty, this was unexpectedly a great quarter and a remarkable year for investing - especially for equities. ACWI was up 7% this quarter and 19% for the year, marking double-digit gains for three years in a row. U.S. markets did particularly well with S&P 500 reaching new highs, ending the year with a 27% gain. International markets finished positively overall – though to a lesser extent, up 8% as European markets outpaced Asia-Pacific markets by 13% and emerging markets posted muted returns, pulled down by China.

Notably, size drove returns this year, with mega-cap stocks leading the market, and small-cap stocks up about half as much. While large-cap growth performed on par with large-cap value, small-cap value impressively outpaced small-cap growth by more than 25%, benefiting from the economic reopening earlier this year.

As markets actively look for the next moves of major central banks, the tighter-than-expected monetary policy announced at the Fed’s November meeting complicated the economic backdrop; concerns over long-term inflation were soothed, while tightening prompted uncertainty around future growth. With investors retreating to safer Treasurys during the quarter, the 10-year U.S. Treasury yields declined to 1.52% but were still 60 bps above where they started the year. As a result, U.S. aggregate bonds had a flat quarterly performance with long-duration bonds leading other bond segments, down 1.7% for the year.

Strategy Performance

New Frontier’s entire suite of ETF portfolios delivered positive returns in Q4, adding to strong annual performance largely led by U.S. equities. Across all strategies, aggressive portfolios did better than conservative on an absolute basis due to equity performance - consistent with major trends throughout 2021.

New Frontier Global Core and Tax-Sensitive portfolios outperformed the benchmarks in Q4, with only the all-equity profiles slightly trailing due to exposure to riskier equities that underperformed the broad markets.

Multi-Asset Income (MAI) portfolios outperformed benchmarks by more than 2% for the quarter, mostly driven by U.S. dividends and REITs that outperformed international dividends. MAI portfolios are providing consistent yields of roughly 3% - 3.5%, over twice as much as yields on broad equity and fixed income markets.

Performance Contribution

U.S. REITs dramatically recovered from 2020 to become the best performing asset class both for the quarter and for the year - an overweight which contributed most to the relative performance. U.S. minimum volatility stocks continued to add positive returns in the more conservative portfolios. While international developed markets did not help much this quarter, Switzerland, as a single-country diversification to Eurozone exposure, rose 13% in Q4, greatly boosting the relative performance.

Looking at the full year, two other notable drivers to the annual performance were Canadian markets and small-cap value stocks, both of which outperformed the broad equity markets in the first half of 2021, ending the year up more than 27%.

The main performance detractors for the quarter and the year were exposure to Asia-Pacific markets, allocations to China, and small-cap growth in the more aggressive portfolios.

On the fixed income side, long-duration bonds were the biggest contributor to the performance for the quarter; however, gains were offset by losses from the first quarter, resulting in a negative annual contribution. The dollar increased by 1.4% in Q4 and 6% annually, weighing down returns of international treasuries and emerging markets debt, both detracting from performance. Alongside rising inflation, high yield bonds held up better than investment-grade corporate bonds due to their resilience to inflation throughout the year, while U.S. TIPs were the best performing bonds in 2021.

Market Insights

Intuitively, pandemics should not be good for markets, but that was clearly not the case this year. Despite many threats, it has been a period of globalization, economic stimulus, and measured consistency from central banks and policymakers. These conditions have contributed to fast economic rebounds and surprising (good) corporate performance. But positive surprises by their nature cannot be expected to recur, and the stellar stock returns of the pandemic should not be expected to continue.

Ongoing Pandemic

Many predicted the end of 2021 would mark the end of the pandemic and a universal return to near normalcy. Unfortunately, the highly transmissible Omicron variant emerged and surging cases have been a major setback to many social and workplace related plans. Markets, however, were quick to express optimism over evidence of the relatively low virulence and relatively short wavelength of the variant. Hopes have switched from an end of the pandemic to a transition to living with endemic COVID.

The Economy

With inflation reaching levels not seen since 1982, and the Fed removing the term “transitory” from inflation expectations, inflation dominated economic discussion this quarter. Now that the Fed has stopped using the term “transitory” markets have begun to understand what it means. The debate is no longer whether prices and wages will fall back to pre-pandemic levels, but whether prices will stabilize or spiral.

It is clear that inflation is coming from an excess of demand over supply. Some economists, notably Larry Summers, argue that this could have been avoided with less stimulus, while others say a large stimulus was necessary to avoid economic catastrophe. Either way, most thoughtful economists continue to expect prices to stick at current levels but stabilize going forward. Therefore, future inflation should moderate. Fed Chairman Powell’s reconfirmation makes it more likely the Fed will be able to enact strong policy to manage inflation beyond the already announced tapering of asset purchases ending in March 2022 and expected rate increases thereafter (the market currently expects three 25bp increases in 2022).

Predictions aside, inflation is related to fast economic recovery—2021 was certainly better economically than predicted, with high growth and high employment. This positive surprise contributed to the market returns, but it also contributed to inflation as spending increased ahead of production.

Nuances of inflation should also be considered. Wages and prices for services tend to be sticky, consumer goods are somewhat less sticky, and commodities tend to float freely according to supply and demand. As an example, natural gas prices demonstrate their sensitivity to supply and demand shocks below. Gold deserves special mention as it is priced more as an investment asset than a consumable commodity—as such it should be viewed as a long-term inflation hedge rather than an immediate one.

Source: Bloomberg

Full employment is a necessary step towards improving supply. While employment at 4.2% is close to normal levels, many potential participants have not reentered the job market and job turnover is extreme. Job turnover is generally seen as a positive for economists as it means that workers are moving towards more efficient labor and acquiring new skills. However, there are also frictions where knowledge is lost, and new skills take time to acquire. Corporations are efficient at preserving short-term revenue, but may suffer from loss of knowledge, maintenance, and innovation. Many of these costs do not show up on corporate earnings, so while true productivity should improve at some point in the future, there may be an unmeasured loss of value yet to be accounted for.

U.S. Politics and Taxes

Politics has not majorly disrupted markets as government shutdowns have been avoided, while Fed officials and judges have been confirmed. The slim Democratic majority has pushed through some significant legislation, including a pared-down infrastructure package, but expectations for radical legislation have been lowered. A silver lining of less stimulus is lower inflation pressure, and a less politicized Fed is good for the economy and markets.

The potential for serious tax changes appears less likely. Tax considerations are an important part of investment planning and portfolio management but should never be the reason to make an incorrect investment decision. Given the unknown and unlikely radical changes to the tax code ahead, most investors are well advised to continue to make sound investment decisions based on what is known today rather than speculate about the future.

ETF Trends

ETF investing accelerated with $902 billion in net inflows. Notably, ESG investing came into focus in 2021, as the popularity of the trend grew with record inflows. The inflows can be attributed to a combination of performance chasing and increased demand from both institutional and retail investors. This contrasts with expanded understanding that many ESG products are built using necessarily subjective rating systems. Other practices include corporate “greenwashing” where firms make largely cosmetic corporate changes to improve their ESG scores and gain access to higher valuations from ESG investors.

Active ETFs also grew dramatically. Despite the poor performance of the flagship Ark ETF in 2021, Cathy Wood became the first celebrity portfolio manager in the ETF format. Active ETFs benefited from the loosening of filing regulations in late 2020 and accounted for roughly 60% of all new ETFs launched this year. This particularly benefited many mutual fund companies seeking to convert their existing funds into the more appealing ETF structure.

Finally, the first Bitcoin ETF was successful commercially, although not as an investment product. The futures-based product has tracked the cryptocurrency well intraday, but predictably underperformed over time. This contrasts to commodity ETFs invested directly in a physical asset such as GLD which maintains a high correlation to gold spot prices over both short and long intervals.

The proliferation of ETFs, and their increased complexity and variety, highlight the importance of a thorough understanding of ETF structure and characteristics. As a result of ETFs transforming from largely simple capitalization-weighted funds, to a whole host of offerings such as active, thematic and specific factor exposure, the need for professional due diligence has increased.

Contrasting the U.S. and China Markets

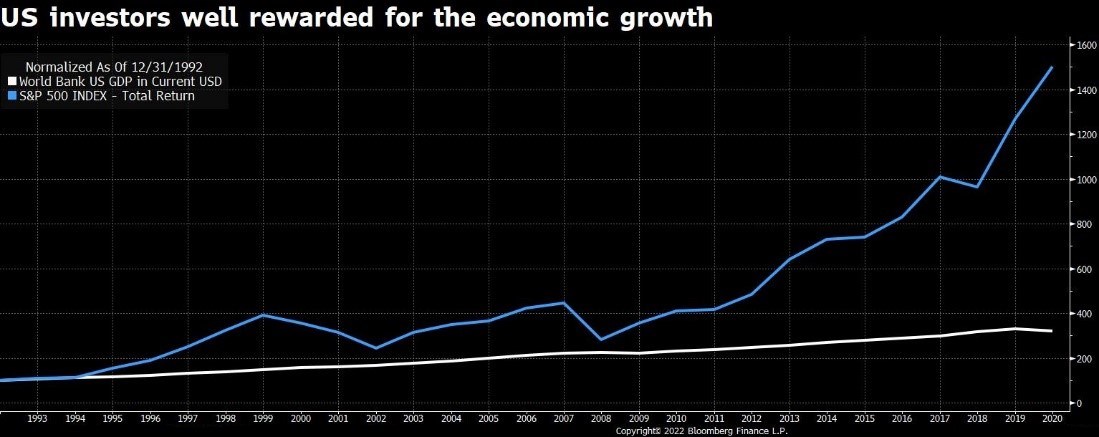

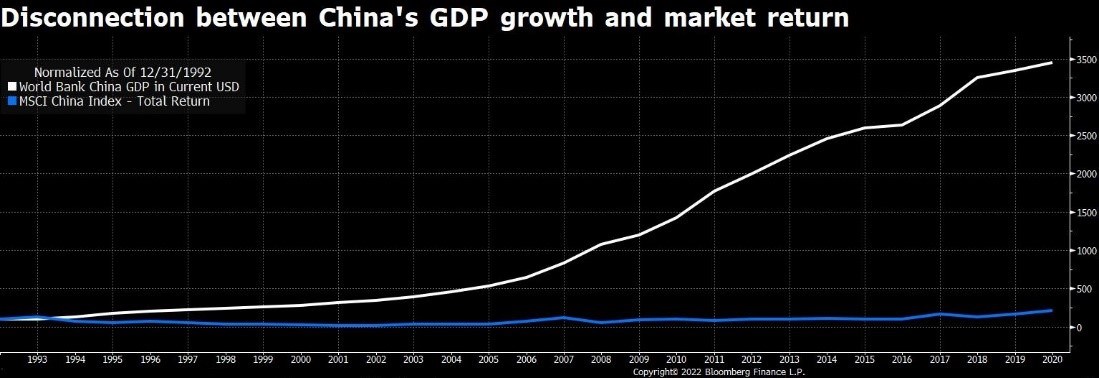

Last quarter’s commentary discussed the exceptional nature of the U.S. equity market and related the high returns U.S. investors have received with the favorable cultural and regulatory environment of the U.S.. This was in opposition to China, where investors have not been rewarded for the spectacular growth of the country’s economy. Unlike the U.S., where much corporate regulation is focused on protecting investors, China’s regulatory focus is much more directed to social and political issues over investor interests. Unfortunately for investors, China has enacted further regulations with no end in sight. The chart below contrasts the relationship between economic growth and market return in the two largest economies in the world—in the U.S. GDP rises gradually with dramatic market returns, whereas China’s GDP growth far surpasses its market return.

Source: Bloomberg

Investment Implications

Investing for a single market scenario, such as inflation, is generally not prudent. Sometimes an economic narrative can dominate the consciousness of the investing world, but markets are unpredictable by their nature. Whatever course inflation takes, it is not the only risk to your portfolio. Whether or not inflation persists for some time, other forces and events will also impact portfolio performance going forward.

Similarly, investing in individual assets for specific scenarios is also inefficient. Many assets have some sensitivity to economic forces. For the example of inflation, an asset such as a TIPS ETF directly hedges the risk of inflation, but inflation risks can be more effectively managed at the portfolio level by optimizing the weight of all assets according to their exposure to inflation.

Conclusions and a Look Ahead

Now that we finally understand the meaning of “transitory” inflation, focus has shifted to a new buzzword, “endemic”, with the economy and certainly the stock markets seemingly getting over (or at least resigned to live with) the pandemic. U.S. equity momentum has been strong, all the same, concerns about valuations on technology and U.S. growth stocks underscore the importance of global diversification and provide potential for a rotation into depressed value stocks. It’s fair to say that the U.S. currently is tilted towards growth compared to other developed markets, particularly Europe, which are tilted towards value. Balancing the potential returns with their associated risks remains a challenge for investors.