Recent market volatility after years of stable growth in US markets has shaken the faith of some investors. However, our analysis shows that historically, staying invested through volatile periods has provided superior returns when compared to selling when volatility rises and reinvesting later. Some of the greatest upside returns have happened shortly after volatility spikes, and investors who have pulled out have missed out on important opportunities for portfolio gains.

Blog

Decoding Dividend Funds: Balancing Trade-offs for an Income Portfolio

With bond yields rising dramatically since early 2022, investors have been piling into money market funds and short-term Treasury Bills to get a risk-free return of more than 5%. Although there’s one problem with sitting on cash – no capital growth. As highlighted in our recent blog on cash reinvestment, short-term securities have insufficient inflation-adjusted return to meet ...

Fed Actions and the Nervous Reactions

After three quarters of improving economic outlook amid increasing expectations for a painless decline in global inflation, markets and pundits alike have become less optimistic about a soft landing as they reacted to frustration from the Fed. In an unfavorable scenario for stock and bond investors in a quarter with little fundamental change, economic worries increased while in ...

When Cash Isn't King: The Advantages of an Optimized Portfolio

Key Highlights Rising interest rates have led some investors to shift to cash, seeking a risk-free 5% return. Yet, a more effective strategy combines cash with ETFs within an optimized portfolio. An optimized portfolio is engineered to achieve the highest expected return for a given level of risk, making it a superior choice for achieving financial goals compared to holding ...

US Credit Rating Downgraded: New Frontier's Take on the Fitch Announcement

Do Downgraded Treasurys Still Belong in Your Portfolio? What Does the Treasury Downgrade Mean for Your Portfolio? The creditworthiness of the US Treasury is hugely important – the function of the global economy is built on it. So at first the decision of Fitch, one of three major ratings agencies, to downgrade US debt would seem to matter. But this is old news. Fitch merely do ...

Efficient Frontiers in Theory and Practice: Longer Horizons Deliver Better Wealth Security

Most students of modern finance are familiar with the efficient frontier chart, which shows the range of expected returns and risks for optimized portfolios. Because these calculations are performed when the portfolios are constructed, before they are invested, the values on the chart are estimates, almost sure to differ from the observed risks and returns. An Important Diff ...

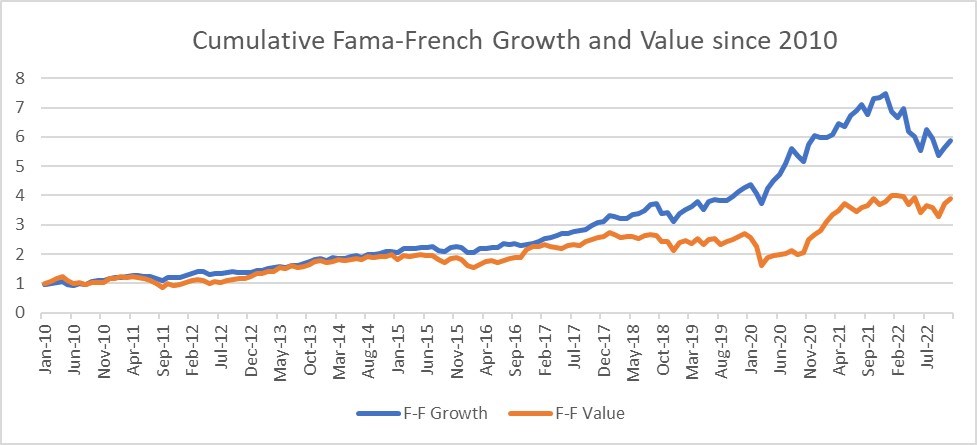

Firsts and Worsts - Four Reasons Why 2022 Won't Happen Again

In 2022, numerous unprecedented events led to a decline in asset prices across all markets, resulting in an historic decline in global investment wealth. This scenario is unlikely to reoccur for four primary reasons, which we discuss below. Key Takeaways: 2022 was an historically bad year: the worst in centuries for bonds, and the first time in history when both stocks and ...

Is 4% a Safe Retirement Withdrawal Rate?

Retirement is fraught with uncertainty. Individuals approaching retirement face a variety of questions regarding their families, their health, and long-term market uncertainty. Financial planners must answer questions from clients seeking guidance and hoping to establish a secure financial cushion for their later years. One common question is, "how much do I need saved at retir ...

Understand Recession Realities: How Financial Advisors Can Help Their Clients Navigate Turbulent Economic Times

Don’t Panic In the face of pessimism about the possibility of a recession and the Fed’s efforts to curb inflation at any cost, many investors may be worried. An analysis of the historical data from past recessions suggests that waiting for favorable market conditions could leave an investor at a disadvantage, compared to those who remain in, or enter, the market, irrespective ...